My first full year investing: I’ve never had such a rollercoaster of failures, triumphs, lucky breaks, and emotions. Oh, the emotions. The pain of multiple gut punches after handfuls of bad decisions earlier in the year; the fantastic relief of reaching breakeven; the bittersweet success of stocks doing well (but not as well as the ones I ‘missed’'; the excitement of meeting investors and management teams from across the world; and most of all, the satisfaction of having an epiphany moment, realising I had been doing it wrong all along. There’s never a dull moment.

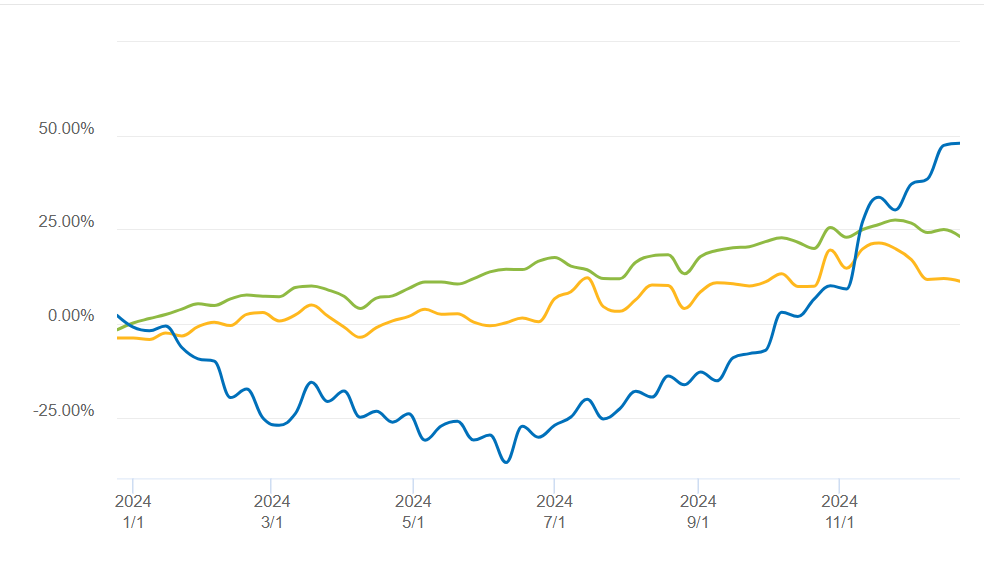

While still making plenty of mistakes, I couldn’t be happier with my performance, finishing a respectable 48% up for the year. This is despite being down 42% by the summer. That’s a 155% return since June 1st. Losing 42% of my family’s investing pot felt like a very expensive tuition, but it seems to have paid off. Pain and anguish put me in the right frame of mind to learn quickly and deeply. My approach was notably different for the first and second half of the year, and I’ll explore those differences later.

I’ve done a few portfolio updates before. I published my latest, entitled ‘Like a Phoenix… I hope!’ on September 1st, just before I started at Stanford GSB. I will begin writing these regularly, either quarterly or bi-annually, depending on the level of interest. This letter will cover the following, in this order:

My Portfolio Performance

Recommendations* Performance

Lessons Learned

A Brief Life Update

*Recommendations for investors to consider; not financial advice; do your own due diligence.

My Portfolio Performance

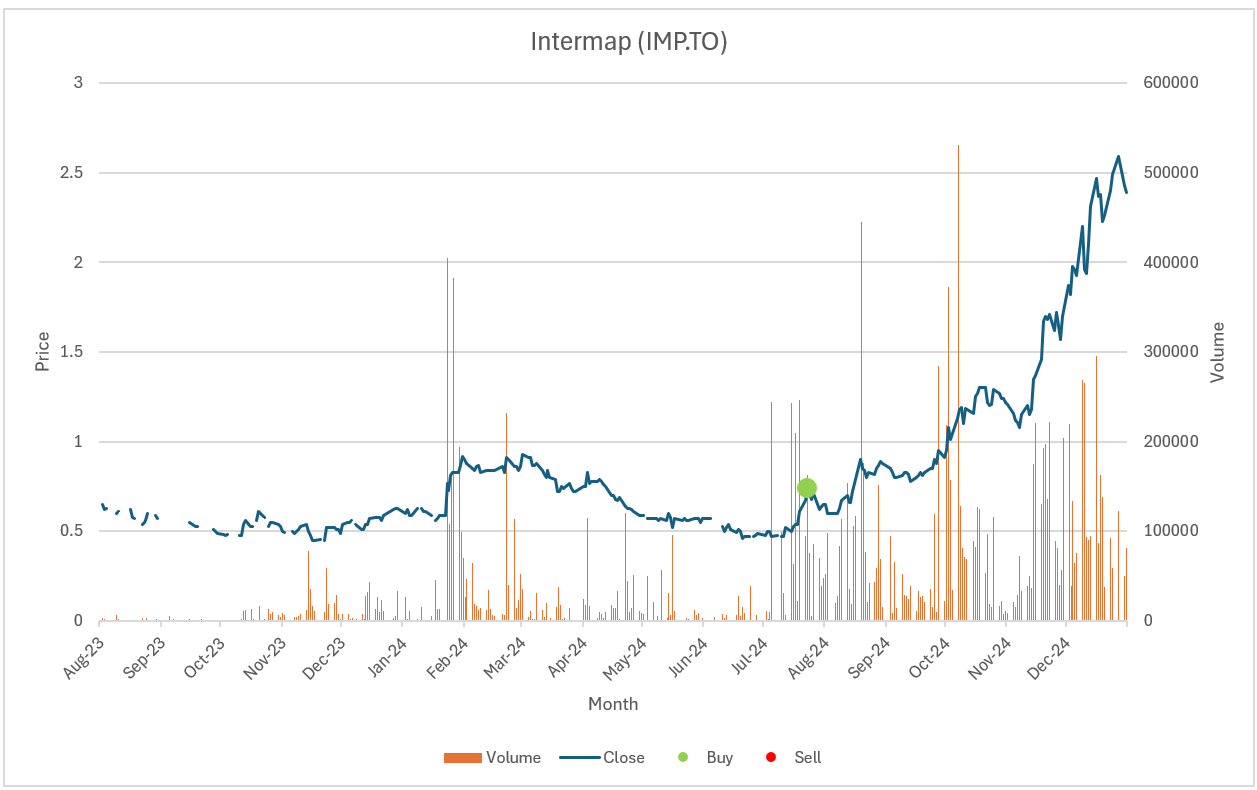

FY2024

Achieving a 48% return would ordinarily be something to write home about, but this feels like a modest win in a year with winners up multiple thousands of % (e.g., TSSI). With AI, drones, and many junk stocks up so much, 48% feels a little above average. Still, I’m pleased to have more than quadrupled the IWM benchmark of 11%.

Considering where I came from earlier in the year, I’m delighted with my performance. I was down 42% in June, feeling very miserable. Something clicked in the summer for me, though, which turned my performance around. Since then, I finished the year up 155% from the trough mid-year, so I’m thrilled. I’ll review what clicked in my lessons learned section.

Note: I have included both SPY and IWM as benchmarks. The IWM is a more relevant benchmark because I invest predominantly in micro/small caps. I included SPY simply because many investors use this to benchmark.

Note 2: All performance % given in Time Weighted Returns.

Since Inception

I was of mixed mind as to whether to start my performance in 2023 or at the start of this year. After all, I started investing in mid-2023 with a little money and ramped up through 2023 to what I'd consider "fully invested" by the year's end; I was only getting started and was effectively treating it as practise money while I increased the portfolio size.

That said, after running an X poll, people seemed to think it was better to include. Since I never did an annual review for the 2023 chart, let’s start there.

My 2023 was not good. I ended the year slightly in the red. At first, I had some lucky breaks, but my luck soon dried up, and my poor practices were exposed. My approach was fundamentally flawed. In contrast, the indexes were notably up in 2H2023, so my underperformance in 2023 meant I had plenty of catching up this year.

Despite a great 2024, I’m only just approaching the SPY’s performance, though I’m pleased to have overtaken the IWM.

I will note that, at least for now, I am long only. I use zero leverage and no options or derivatives. I invest in businesses that I believe will be worth more money in the future.

I see personal performance in the same way as I would a sports team. It comes down to a combination of the players on the team and then having the strategy to know how and when you deploy those players. That means picking a lineup of investments you think will outperform and portfolio allocation, that is, knowing when to invest heavily, light, or not at all in each of these. In the next section, I’ll review the players I have on the field and on the bench, which I do in this next section. After that, I’ll share the lessons I learned.

Research Portfolio

Below, I include my tracker for every company I have ever published a recommendation for (to research, DYODD).

Since the September update, I have added HeartCore and Streamline Health to the list; I have not removed any from the list.

The average return for the picks is a 26% gain, or 45% annualised (open for an average of 211 days). The difference between my earlier and later picks is pretty extreme. My last seven recommendations are all positive and up 90% on average.

I’ll go over every investment recommended in two tiers: my current investments (players I have on the field), and all others active recommendations (players I have on the bench). I have not removed any players from the bench since my last report; please check my previous reports if you would like to see closing comments on those.

My Current Portfolio

My portfolio is highly concentrated, currently consisting of just three companies. I believe in investing more money in my best ideas, and that principle has paid off in the last six months. I expect this approach to be more volatile, and I am comfortable with that. I aim to reduce risk at the individual stock level rather than at the portfolio level, investing in companies in which I believe there is a near-zero chance of capital loss and which may double (at least) within twelve months.

#1 - Locafy (LCFY)

Initiation thesis, Aug 12th 2024; price: $4.33 (CAD)

Interview with management, Nov 17th

Expanded thesis, Nov 25th

Product overview and Q&A, Dec 16th

Current price $6.91; return to date: +60%

The company reported Q4 and Q1 earnings. I appreciated the cost-cutting, but there were no big surprises for better or worse.

More importantly, the ‘transformational’ news we had been waiting for finally came through in November. Locafy announced a contract worth up to $6.5m of ultra-high-margin SaaS. I believe this contract has a good chance of taking the company from cash flow almost-breakeven to ~$5m in earnings by the summer.

If this plays out, I can’t see this company staying a sub-$10m market cap for long; it would be perfectly reasonable for the stock to quintuple at least once the Q2 results are released. If they only get a fraction of those earnings, they’re still transforming from an unprofitable microcap to a profitable one, and I think the market will reward them. I don’t see much downside here, but massive upside. I like the risk-reward here so much that I went in extremely heavy at a concentration that would make many out there nauseous, including me. It’s a volatile stock, but volatile up for now.

As I understand it, a couple of other large contracts are in the works. Closing one or two more deals would greatly help with client diversification and earn a higher multiple than I used above.

#2 - Streamline Health (STRM)

Initiation article, Dec 12th 2024; price $3.24

Current price $3.76; return to date: +16%

I published my thesis on Streamline Health only a couple of weeks ago. The thesis went something like this: Streamline is highly likely to bring forward its AEBITDA breakeven guidance, a milestone that STRM investors have been dreaming of for a long time. Revenues and ACV will have to jump significantly to reach the new guidance.

Streamline reported its Q3 earnings soon after my article, which was everything I had hoped for. Not only was there a healthy bump in ACV (booked and implemented), but the company accelerated its expectation for achieving the SaaS ARR adjusted EBITDA breakeven run rate to the first half of fiscal 2025. Since the earnings, they also released one client win, and I expect more to come. I’m surprised the market hasn’t reacted more; perhaps it’s still in disbelief. Given how cheap it's currently trading, it’s had to imagine the stock not doubling or more by early next year.

#3 - Crexendo (CXDO)

Article on June 27th, 2024; price $3.07

Hosted Q2 review and Q&A with management on July 8th, 2024

Updated thesis, Nov 9th

Current price $5.23; return to date: +70%

The thesis here is simple. Crexendo is the best UCaaS provider out there and is eating the market share of the two larger competitors. It’s a compounder that should grow reliably and quickly over the next few years. There’s plenty of operating leverage, a brilliant management team and a stellar balance sheet. This is a put-in-inside-your-closet-and-take-a-look-in-a-few-years stock, though it’s also been fun to trade around. Sell after a run, buy on a pullback. It’s been very predictable.

I’m very pleased with CXDO’s business performance. Since the start of Sep, Crexendo has announced its data centre expansion in Australia, partnerships in Australia, that it broke 5 million users on its platform, excellent reviews, a bigger than ever UGM, one and two licensees poached from Microsoft, and awards in Generative AI usage and for being one of the fastest growing tech companies in the US. I admit, they’re a little trigger-happy on press releases. That said, I would say this company and management team executes more reliably than any other I know.

The Q3 results were excellent, though marginally less impressive than Q2, so the stock hasn’t gone anywhere since then. It’d be nice to see it take the next leg up soon, but I’m very comfortable waiting for the price to catch up with this level of execution. I had been a little light on this name but went heavy again recently.

Other Recommended Stocks

These stocks are still active in my tracker but are currently not more than tracking positions in my heavily concentrated portfolio. I like nearly all the companies and await the right re-entry (and for some free cash). In alphabetical order:

Creative Realities (CREX)

Article on Feb 6th, 2024; price: $3.13

Follow-up article on Jun 4th, 2024

Current price $2.45; return to date: -22%

Since September, Creative Realities has announced its Q3 results and significant traction in sporting venues and QSR. Q3 was decent enough, though nothing spectacular, but the business looks excellent overall. This year, we’ve seen great revenue growth, growing margins, an improved balance sheet, and an expanding pipeline. I think the company will have a terrific 2025.

It’s apparent what’s holding the stock back. Discussions surrounding a contingent liability are ongoing, and investors are widely pessimistic about how that will turn out. After speaking with management, the following points came across:

The liability is recorded at the worst possible outcome.

Discussions are ongoing with the involved party.

Management is considering various solutions, including credit facilities, debt, or seller-financed notes.

The goal is to address the liability without resorting to a capital raise.

The agreement allows for a six-month extension, which management is confident they'd get.

I like the management team. I trust they're doing their utmost to resolve the situation.

Management will keep investors informed as the situation develops. A decision will be needed by Feb.

My gut tells me that the market is overreacting and that the uncertainty has a more significant impact on the stock than the realistic worst-case scenario would deserve (whatever that turns out to be precisely). Once the liability is resolved, I think a huge weight will come off the stock again. I prefer to be cautious, so I will sit on the sidelines until I feel the situation is resolved satisfactorily.

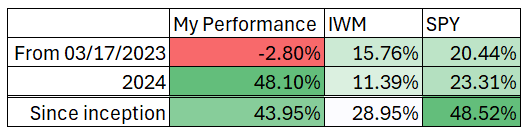

Geodrill (GEODF / GEO.V)

Article first released Aug 12th, 2024; price $2.40 (CAD)

Current price $3.07; return to date: +28%

As a reminder, the thesis was that Geodrill took drills offline to move them to safer geographies, temporarily causing the numbers to look bad. The drills have been deployed again with longer-duration contracts and higher-quality companies. They reported Q3 results, which were excellent. The stock is performing well and heading up steadily. I think the company will be sold in due course, but expect continued positive momentum in the meantime.

HeartCore Enterprises (HTCR)

Interview with management, October 1st

Initiation article, October 13th 2024; price $0.81

Current price $1.82; return to date: +124%

This stock has been a little rollercoaster in itself. The thesis was very simple: the company was about to make a lot of money from a big IPO, and the market hadn’t realised it yet. Sure enough, they made a lot of money, and the stock skyrocketed. The most surprising thing is that the stock is still headed up. For clarity, I am now out of the stock after more than doubling my money. I expected the stock to cool off, but it hasn’t. They appear not to have completed any IPOs this quarter, so I’d say the stock at these levels is unjustified. I think once the market sees the Q4 results and sees the company back in unprofitable territory, the stock may tank, hopefully providing me with another entry point.

I still have confidence in the business’s future. Their software could land well in the US in late 2025, making the business look very cheap. In the meantime, I think there are plenty of opportunities for more IPOs to close. Those generate practically free cash for the company, giving space and time for the rest of the business to become profitable.

An interesting observation is the restraint management is showing at these prices. The company could raise equity at these elevated prices, but it is not. I see it as another testament to the management team’s belief in the medium to long-term prospects for the company, and it also shows they do not need to raise cash to achieve the growth they are hoping for.

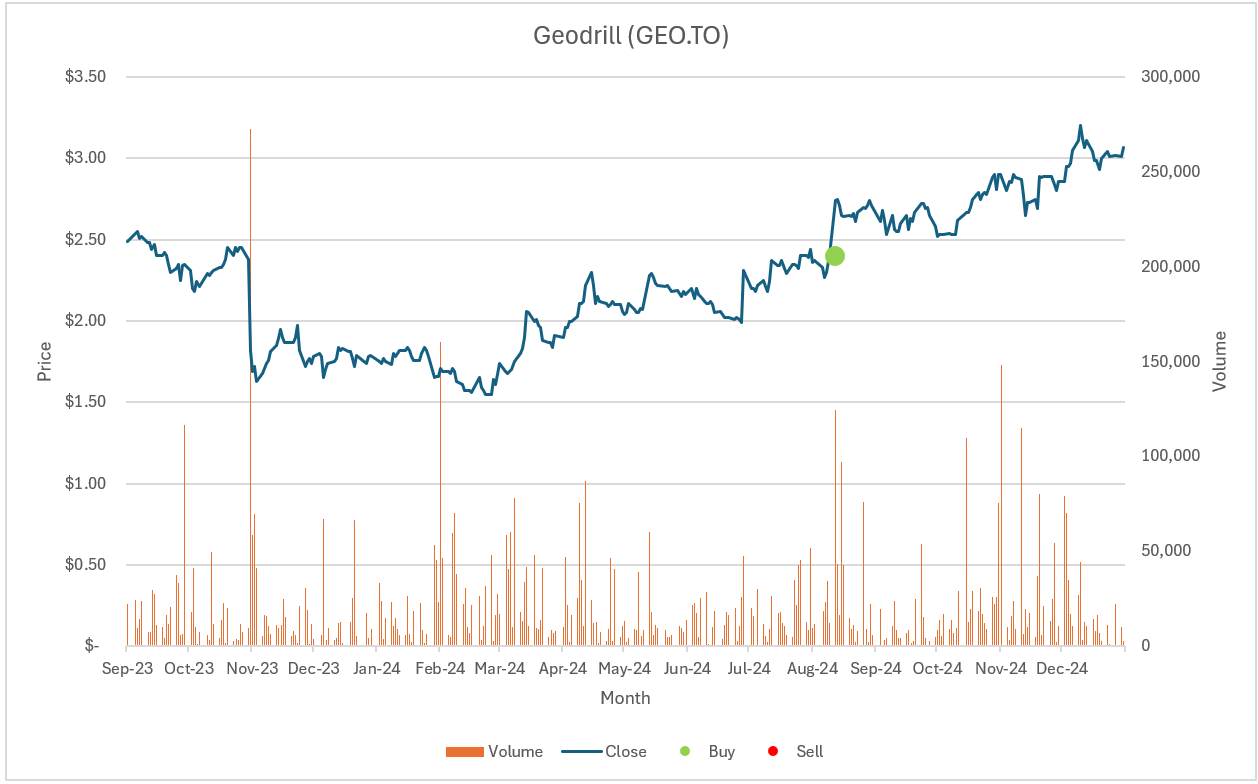

Intermap Technologies (ITMSF / IMP.TO)

Abbreviated thesis July 23rd 2024; price $0.74 (CAD)

Complete thesis on August 20th 2024

Current price: $2.39 (CAD); return to date: +233%

By far, my biggest winner in 2024. The thesis here was another simple one. The core business is doing great, but they also have an enormous project in Indonesia that will dwarf the current business if it gets funded. Well, it got funded (as expected), and the stock has exploded. I would note that the company isn’t guaranteed to win all of the Indonesia project, however likely, so there’s more risk at these elevated prices.

Arguably, my biggest mistake of the year was trimming this one down too soon or not going even heavier than I did. After more than doubling my money, I thought the stock was getting overextended. I took a lot off the table to put it into LCFY, which I thought would take off sooner—a reminder that portfolio allocation is challenging, and I won’t always get it right.

The rest of the business continues to do well, as evidenced by stellar Q3 results, a defence/security project win, a second one, and continued traction in insurance.

I haven’t decided when to get more heavily into this one again. Wait for a pullback or get back in before it sails away without me? We’ll see.

Kraken Robotics (KRKNF / PNG.V)

Article on Aug 12th, 2024; price $1.27 (CAD)

Current price: $2.75; return to date: +117%

Kraken Robotics' stock has shown remarkable resilience despite a modest Q3 report and a capital raise. The market seems focused on the company's long-term growth prospects. While Q3 revenue was slightly weaker, this appears to be a minor setback in an otherwise strong growth trajectory.

The market's optimism stems from Anduril's construction of a new AUV manufacturing facility in Rhode Island, set to open in late 2025. This facility, capable of producing 200 Dive-LD AUV hulls annually, represents a potential $600 million annual revenue opportunity for Kraken as a key subsea battery supplier. The expansion offers a significant supply chain opportunity and validates the growing AUV market demand. Anduril aims for full production capacity by the end of 2026.

Kraken’s demonstration of its new Autonomous Launch and Recovery System (ALARS) for the KATFISH to over 40 naval customers and partners likely generated significant industry buzz. The live demonstrations showcased impressive autonomy and high-resolution real-time synthetic aperture sonar data, including wireless streaming to a remote audience.

Nexgel (NXGL)

Article on Jul 26th, 2024; price $2.74

Current price: $4.46; return to date: +62%

My thesis for NXGL was that the core business was going very well and looked cheap, but they also had multiple big growth levers in 2025, not least of which was an AbbVie partnership, which provided enormous upside. However, the business has done significantly better than I expected in 2024. One of my recent X posts summarises it nicely.

In July, $NXGL announced preliminary revenue for Q2 to be $1.4M, up 20% year-on-year. It also guided for Q3 revenue to be $2.2M and Q4 revenue to be $2.6M. This news was took a couple of days to sink in, but then the stock exploded from $2.10 to $3.20.

Since then, the stock has been trending downwards, giving back a lot of those gains until hitting the 200ma. Today, NXGL issued a preliminary announcement: revenues in Q3 of $2.85m. That is up an enormous 133% YoY, and 98% sequentially. This is CRAZY good news. They didn't just smash their Q3 estimate, they comfortably beat their Q4 estimate a quarter early, and expect continued momentum of growth in Q4. The stock was up today almost 19%, but I can't imagine it stopping here. The stock hasn't even reached $3.20 yet. Considering the reality was significantly better than the guidance, it should sail past $3.20 and keep going.

But it didn’t stop there. The Q3 results were even better than expected, hitting $2.95m. Not only were the results better than expected, but all the commentary on the various growth levers was very bullish, too; I summarised them in a recent X post.

I’m excited for an even stronger Q4, driven by the Christmas seasonality of new products that have grown rapidly in 2024. By Q1, AbbVie’s product should be launched, so it should be action-packed for NXGL shareholders in the next few quarters. The stock seems to be consolidating, perhaps we’ll even see a pullback which I would welcome. But I expect it to continue heading up soon enough.

Perma-Fix (PESI)

Article on Nov 17th, 2023; price $8.08

Current price: $11.07; return to date: +37%

I’ve grown skeptical of Perma-Fix, particularly regarding the management team’s execution. The core business has been struggling, and I don’t like the raises they’ve done. I’m letting this story play out in the tracker, but I’m not comfortable enough to invest my money. Once Hanford ramps up, I’ll probably sell in the tracker.

I would note that the chart looks good, though. Trending upward nicely with higher lows. It looks like a good place to buy if you’re comfortable with the team.

Safe Bulkers (SB)

Initiation article on Jan 24th, 2023; price $3.12

Updated article on May 31st, 2024

Current price: $3.57; return to date: +26% (includes 12% in reinvested dividends)

There’s no other way to say it. The stock has done terribly in the past few months for an obvious reason. Baltic Dry Index rates have plummeted since I last wrote, falling from 1800 to 1000.

The dry bulk shipping market is expected to worsen in 2025 and 2026. The potential resolution of geopolitical conflicts and shipping route disruptions could lead to shorter sailing distances. Given China's significant role in the market and the uncertainty around its economic performance, slower growth could negatively impact dry bulk demand. To help balance supply and demand, increased ship recycling is forecast for 2025 and 2026. Freight rates are expected to face downward pressure across various vessel segments. That said, this is probably factored into the price by now.

It also didn’t help that several dividends were re-invested (on paper) at higher stock prices, dampening the return as the stock has fallen.

I suppose Safe Bulkers is a reminder for me that I’m not yet confident in industries with such strong cyclicality. In hindsight, I should have closed this one out when geo-political crises had pushed rates much higher, and my return was great. I’ll probably still look to sell it the next time the rates are high, and the stock is doing well. Until then, I’m happy to wait with it in this tracker, be it a year or three. I’m not currently invested. I still like the management, the execution, the fleet and the price.

Snipp Interactive (SNIPF / SNP.V)

Article on Apr 17th, 2024; price $0.12 (CAD)

Current price: $0.10 (CAD); -17% loss to date

This is a good long-term hold, but I got the timing wrong. Check my last report for a breakdown of how. I exited the stock a while ago and have been waiting for the momentum to reverse.

Given that the management team had already told the markets they expected a killer Q3, I assumed the market wouldn’t care or reward Q3, instead waiting for more consistent, improved results. Sometimes, I give the market more credit than it’s due. The market celebrated the excellent quarter by breaking the downtrend. It’s another HTCR, except I missed this bump.

On reflection, I like where they sit on the chart. However, I need to re-examine this one closely. Although the core business is doing well, Snipp Media could send this stock into overdrive. I’ll probably check in on Snipp soon.

Tag Oil (TAOIF / TAG.V)

Article on May 6th, 2024; price $0.63 (CAD)

Current price: $0.14 (CAD); -78% loss to date

This is another stock where my timing was off—way off! My last update details why. Despite the awful loss so far, I’m leaving Tag Oil in my tracker because I believe the company is very cheap compared to its assets. If the right things fall into place, I’ll want to jump back into this stock quickly, so I’m keeping a close eye.

TAG Oil has undergone significant changes recently, including a major leadership restructure and strategic operational shifts. In December 2024, Abdel (Abby) Badwi was appointed Executive Chairman and CEO, replacing Toby Pierce, who stepped down to pursue other opportunities. This change is part of a broader restructuring effort, with Badwi having relocated to Cairo in May 2024 to focus on the company's Egyptian operations.

The company is streamlining its operations by eliminating several Canada-based positions to reduce costs and focus resources on capital spending programs. TAG Oil has also completed a $6.8 million equity financing to strengthen its cash position and signed agreements to sell New Zealand royalty interests and offer participation in the BED-1 concession to strategic partners.

On the operational front, TAG Oil is progressing with the approval process for a significant acquisition that would expand its Abu Roash F (ARF) acreage from 26,000 to over 500,000 acres in Egypt's Western Desert. The company's BED4-T100 well is currently producing 100 barrels of oil per day, and TAG Oil has announced plans for 2025 that include drilling a vertical well in Q2 and a second horizontal well in Q4.

Despite current production challenges, TAG Oil's expanded acreage position and future drilling plans could make it an attractive candidate for a joint venture with a larger company. The company is focusing on developing its Egyptian assets, particularly the unconventional resource play of ARF, which, if drilling results improve in 2025, could lead to significant value creation.

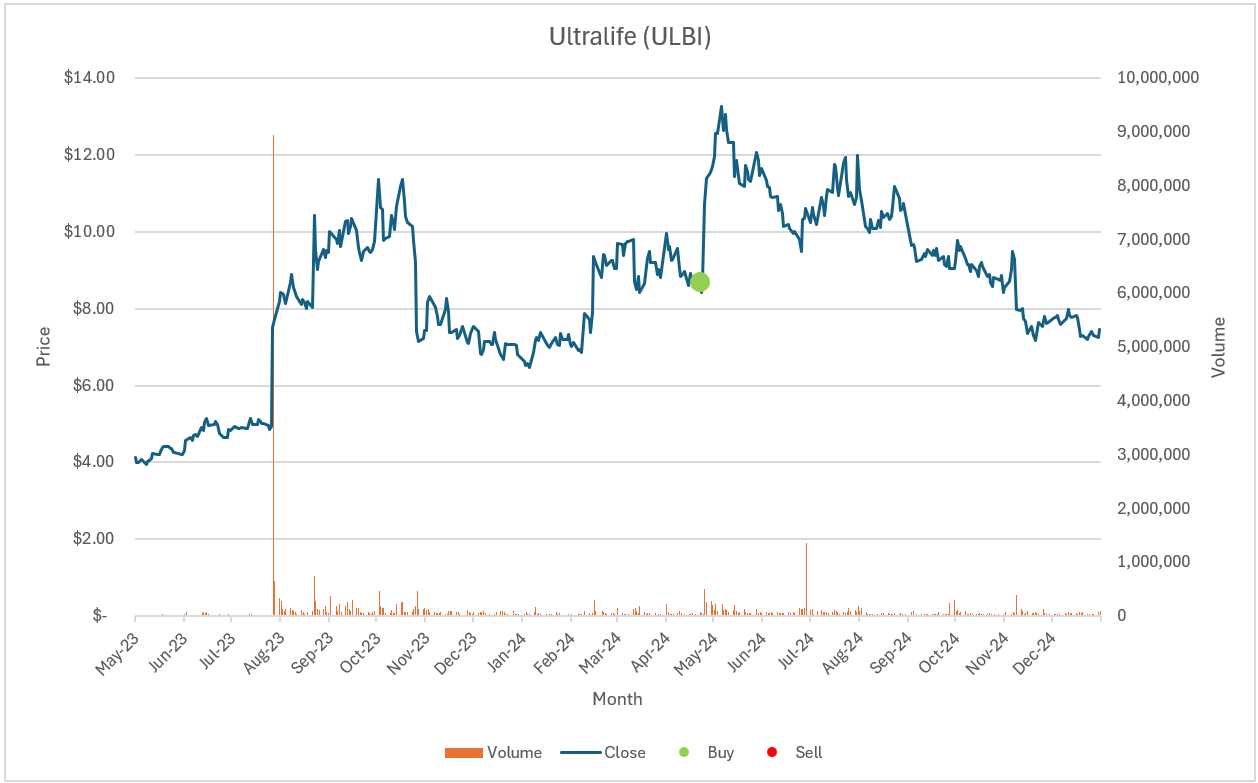

Ultralife Corporation (ULBI)

Article on Apr 22nd, 2024; price $8.69

Management interview released Jul 11th, 2024

Current price: $7.45; -14% loss to date

Q3 was weak, and the market punished the company for it. No growth = no excitement. I have mixed feelings about the business. I may have mistaken a turnaround for cyclicality. The management team has been very sporadic and unreliable in communication. Unless something changes my mind, I plan to remove this from my tracker. I’m not doing it yet because I think we may be near the bottom of the cycle. I’d rather wait until the business happens to string together a good quarter or two and then close it out.

I will note that the business looks cheap, but the value will remain the same unless the story changes.

Vislink Technologies (VISL)

Article on Apr 22nd, 2024; price $5.25

Management interview released Aug 2nd

Updated thesis, Nov 15th

Current price: $3.83; -26% loss to date

Whereas the last three were losers where I made a mistake, this is a loser where I think the market is mistaken.

Vislink's disappointing Q3 2024 results led to a significant stock sell-off, but I see this as a potential buying opportunity. The company faced challenges in the Sports, Media, and Entertainment sectors due to a post-Olympics lull, but I expect recovery by Q1 2025. Vislink is implementing cost-cutting measures and expanding in the Military and Government sector, which shows promise. The company is also focusing on increasing recurring revenue streams.

I estimate Vislink's break-even point at $32 million annual revenue and believe they're well-positioned to benefit from increased NATO-related spending, especially in drone technology. Despite delays in Middle East projects, I'm confident they'll resume.

I view this as a temporary setback rather than a fundamental change. With the current $10 million market cap, I see significant upside potential if Vislink reaches breakeven. I'm holding a small position and considering adding more if the stock remains cheap, particularly as Q1 2025 results approach.

The stock could skyrocket based on drone hype. I hope it stays hidden until H1 next year when I’ll be more interested in investing more heavily.

Lessons learned

I made many mistakes over my first year of investing, but they taught me a tremendous amount. Pain is the best teacher, though learning from someone else’s painful experiences is much more enjoyable. Still, it took me some time to appreciate and understand the wisdom of the great investors. It’s different to learn something in your head, like “Rule #1, don’t lose money”, and to understand it with your heart and actions.

I’ve summarised my biggest learnings into three key principles, and I attribute my performance turnaround to these three principles.

#1 - Manage Risk at the Stock Level, not the Portfolio Level

I learned that risk should not be eliminated at a portfolio level but at an individual stock level. For optimists like me, things go wrong more often than expected. Diversification means you’ve got more pots on the fire and it becomes harder to watch them closely enough to avoid them boiling over. You can’t diversify your way out of risky stocks.

Instead, risk should be managed at the individual stock level. My performance reversed once I stopped losing money picking losers. Avoid losers at ALL COSTS. Do not lose money - ever. Of course, you’ll fail at that mission, just as I have. However, treating stocks as if they might have a ticking time bomb inside them is a great way to invest. Be skeptical. If something might go wrong, assume it will. If it’s still worth investing, even if the worst risk you can think of still happens, you’re probably good to invest.

#2 - Portfolio Allocation to Maximise Returns, not to Minimise Risk

I’ve written about this recently on X. I’ve learned to keep more money in my best ideas, with more immediate momentum and upside, where I understand what will trigger the next leg up. I’ve kept a bench of stocks (my research portfolio) that should go up over time and switched players in and out based on catalysts and technicals. The key is knowing what will happen before the market does and understanding how the market will feel about that. Some examples of me doing it right or wrong:

HTCR - I knew the company was about to make a lot of money, but the market wasn’t taking that in. I believed the market would like the money, and it did. I also saw that the technical setup would make the price realisation happen fast (I almost didn’t expect it that fast).

NXGL—When the company announced better-than-expected Q3 results, I knew it deserved to rise much more than the 10% it did that day. I increased my position. The market didn’t react quickly, but the stock ultimately accelerated upwards.

CREX - I knew about the contingent liability and should have predicted that the closer it got to its due date, the worse the stock would perform. I focussed on the wrong thing (a nicely growing business), ignoring the obstacle to the market pricing the business properly, regardless of how extensive that risk was.

ITMSF - I knew the stock had strong positive momentum; everyone was excited about Indonesia. But Indonesia isn’t a done deal, and we don’t know precisely how much Intermap will win from the contract. While it’s likely a lot, there’s still risk there. So, I took money off the table to account for that risk. That said, I didn’t consider that the market isn’t considering it a risk; they’re acting like it’s a done deal, and the stock seems likely to keep heading upward until it actually gets some bad news. There was no reason to take money off the table because there was no immediate risk.

VISL - After a disappointing quarter, I might as well have moved my money immediately. The quarter will likely weigh on investors’ minds until the subsequent earnings. There is nothing tangible for investors to cling to (as KRKNF did, brushing off a weak quarter because investors could look forward to Anduril’s factory). Money kept in VISL was going to be dead money for some time. I left money in because I like the company and its management, and I believe it’s significantly undervalued. However, the value will remain as value until something changes and nothing is on the immediate horizon. A similar (and more extreme) story could be told for ULBI and FLYLF.

I admit that this is more an art than a science. Judgement and intuition are needed.

#3 - Stories drive Stocks

The age-old question: what drives stocks - fundamentals or technicals?

I believe neither. Stories drive stocks. Fundamentals are merely static snapshots, characters in the story on a single page. It’s our job to understand how those characters will develop or where the story is going. Just as important, we need to be in tune with the listener. What will the fundamentals look like, and how will the market feel about those changes and developments? Technicals allow you to understand how the listener hears and responds to the story.

The most lucrative way to invest is to invest in the companies as the story changes. I’ll call them plot twists until I think of a better name. The moment the market wakes up to a value it hadn’t seen before.

I have learned to ask myself a few questions to ensure I am ready for the plot twist.

What will drive the plot twist? What is the ONE thing the market will focus on, appreciate and reward for this stock over the next month? This is often a growth lever - perhaps an upcoming contract, product or other catalyst that is highly likely to accelerate earnings growth. It could come in one big change (HTCR hitting the lottery) or be a steady acceleration (CXDO slowly dominating a market). Don’t assume the market is smart enough to appreciate multiple plot twists at once - it usually comes down to one thing. That’s the thing you need to know and understand inside out.

What could overshadow the plot twist? Which of the many known risks will the market take seriously enough to override any positive momentum or news the company has? The risks don’t need to occur; it can be sufficiently bad for the market to fear a bogeyman, whether there is one or not. Three risks to positive momentum are more common than any other: capital raises, bad quarters, and technical risk.

Capital raises: This is the ever-present risk, as it could happen anytime. Thankfully, it’s easy to solve. Don’t invest in companies that need capital raises to keep the lights on (raises for growth can’t be avoided but are not bad). CREX falls firmly in this category as the market is highly skeptical of its contingent liability.

Bad quarters: This is very difficult to avoid. Sometimes, businesses can look like they have momentum but string together some bad quarters, and you’re not sure whether it’s a temporary or structural problem. My general advice is not to make investing more complicated than it already is. Don’t try to guess and play the quarter. You’ll probably get it wrong. Sit tight or even take money off the table before the quarter results are released. Sure, you might miss a quarterly pop. But most of the stock movement happens during the time in between quarters. The market takes time to appreciate a good story. You can ride a quarter’s good news for three months before having to worry about another bad quarter.

Technicals: Sometimes stocks go down for technical reasons. If the market doesn’t like the story, be cautious. Avoid downward momentum unless you have an extremely compelling reason. If the stock faces a particularly strong resistance or is overextended, I like to take money off the table. Often, after a big run, the stock will pull back. Sometimes it doesn’t, and that feeling sucks, but hey, you haven’t lost money, and hopefully you put the money in another stock headed up. You’ll probably get another chance, even on the stocks you feel are getting away from you.

A Brief Life Update

I just finished my first quarter at Stanford Graduate School of Business,, and it has been incredible but intense. Academically, the first quarter is the busiest. Couple that with moving with a family across the ocean and setting up in the States, trying to be a present husband and father of two boys, managing an investing portfolio, participating in the Breakout Investor community, writing about investing online, and recruiting for a job, and I’m busier than I’ve ever been.

Studying at Stanford has been fun. I’ve loved engaging with incredibly bright, good-natured people who want to make a difference. Their optimism and determination have been inspiring to see. I’ve also had fun arguing with my finance professor about markets, realising how much I don’t yet know in advanced accounting, and, of course, raising the eyebrows of my classmates by telling them about my latest sub-$10m market cap investment.

Pretty much since as soon as I arrived, recruiting has started for investing-related summer internships. So far, it’s been a series of informal chats and applications, but interviews start in January. I have interviews with the following and am waiting to hear back from a dozen more. I'd love an introduction if you know someone who works at one of these companies.

Anomaly Capital

Brandes

Capital Group

Dodge & Cox

Fidelity

Franklin Templeton

T Rowe Price

Viking Global

Before school started, I attended my first investor conference - Gateway in San Francisco. It was a lot of fun. If you’d like to read about the various companies I chatted with, link here (AMPX, ARQQ, BTBT, DMGI.V, HTCR, LINK, LCFY, NATR, OOMA, SKYH, SOWG, SSTI, ULY, UTI, VISL, VTSI, WYY). I almost attended LD Micro, but exams got in the way. I’m hoping to attend Berkshire, Planet Microcap and LD Micro - hit me up if you’ll also be there.

Writing on X continues to be a lot of fun. Follow me on @sammccolgan (link). Since July, I’ve grown to 4.5k followers, more than I ever expected. This has opened doors to fascinating conversations with brilliant people. On that note, a particularly proud moment for me was being followed by Guy Spier (one of my heroes). I wrote a whole substack post about it because I was too excited.

Update on the Goals from my Last Update

Get into Stanford's advanced finance and accounting classes and try to keep up: I got into them (it took some petitioning) and just about kept up!

Get an internship at the Stanford Management Fund that I can do while I study: I found out I’m not allowed to work during Year 1 of my MBA :(

Break-even in my personal portfolio: achieved and then some!

Get into the MicroCapClub: I was too busy and kept forgetting. I’ll keep this goal.

Goals for the Next Three Months

Land an internship at a company I’m excited to work for.

Get into the MicroCapClub.

Write at least one article about investment learnings on Substack a month.

Double my money in 2025.

holy. i follow a lot of stacks and x accounts, never seen this kind of hot streak in the last seven names.