Snipp Interactive – Turning profitable, fast-growing, strong balance sheet and cheap. What’s not to love?

A Report on Snipp Interactive (SPN:CA; SNIPF)

Thesis

Snipp Interactive (SNIPF; SPN.V) is the second largest position in my portfolio. It’s an easy pick for me. The company is about to become profitable once again following a period of reinvestment, has an excellent growth trajectory with a long runway, a strong management team, and net cash, and is trading far below its intrinsic value. If you can stomach the short-term volatility associated with owning a penny stock, I believe the fundamentals are very attractive and worth a close look.

Introduction

Snipp Interactive assists CPG companies, brands, and manufacturers (whom I’ll collectively refer to as brands moving forward) in generating first-party data for consumers and marketing to them using that data. First-party data is data the consumer gives to the data holder directly. It is increasingly valuable in the context of increasing regulation making third-party data harder.

Despite being a micro-cap company, Snipp has an impressive client roster as shown below.

Snipp operates globally, with offices in 5 countries, deployments in 51 countries, and 20% of sales occurring outside the US (FY2022 call).

The Snipp! CARE Platform

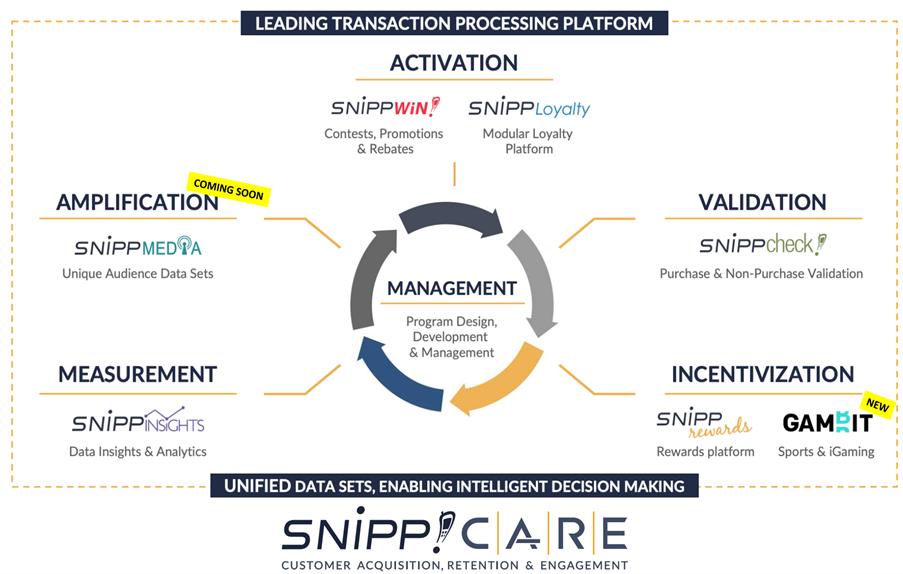

Snipp is a PaaS (Platform as a Service) company. It offers a marketing tech platform called ‘Snipp! CARE’, which provides a horizontal and modular solution that enables marketers to work efficiently and effectively. It’s worth mentioning that while Snipp has competitors for many of the individual modules discussed later, they have no competitor that offers a similar “full package”. They are the only company to offer such a full-service marketing platform, and this is an important competitive advantage.

The core problem this platform solves is as follows. Brands’ products are sold primarily through 3rd party retailers, and therefore brands have little or no relationship with consumers. It means they don’t receive any insights into who is buying their products and can’t encourage them to do anything directly (e.g. try a particular product). That relationship is owned by the retailers. The CARE platform bridges this gap, enabling these brands to build a relationship with consumers. That process consists of both understanding consumers and then being intentional in drawing out certain actions from certain types of consumers.

CARE is modular so companies can start using it for one function (e.g. loyalty programs) and then launch other modules if desired. Snipp breaks down its CARE’s abilities into five main verticals as shown below, each with 1-2 modules that serve that vertical. CARE functions in around 25 languages currently, so a company can easily launch the platform in new geographies.

I’ll now break down the verticals and their respective modules one and a time. While I do though, note that two modules deserve a special mention – Gambit and Snipp Media. Under the forecasting section that follows, I’ll consider these separately from the rest of the business (which I’ll refer to as the core business).

Activation

The objective of activation is to get end consumers onto the platform. Consumers enrol on the platform because they want something in return. SnippWin! encourages consumers to sign up by offering rebates, competitions, gifts and so on. SnippLoyalty adds consumers using a loyalty program.

Consumers often sign up by following QR codes or links from packaging, digital billboards, etc. Once they do, Snipp creates anonymised profiles for users, which are added to or used in later steps.

Validation

The objective of validation is to confirm the purchases a consumer is making. Snipp has developed an AI that uses machine learning to ‘read’ any receipt from any store at any location. Consumers take pictures of and upload their receipts onto the CARE platform, and the AI extracts the data for all purchases to ‘validate’ the purchase. This step fleshes out a consumer’s profile, providing data on spending habits that can be analysed with other modules. For each item purchased, brands can understand where, when, with what other items, how much was spent, and so forth. The service is called SnippCheck.

This module helps solve another key problem for brand marketers – measuring ROI in advertising. One reason digital advertising (e.g. Facebook ads) has taken so much market share from traditional advertising is because it gives better information on ROI. Marketers can at least see eyeballs and click-through rates, which is a lot better than nothing. However, this kind of advertising still falls short of seeing if a purchase was made or not. A brand would not know how many consumers saw an ad online or on TV and went to purchase the product in-store as a result. In contrast, SnippCheck’s ability to add in-store purchase data to the user’s profile enables a more complete ROI to be measured.

Currently, around 1 million people upload receipts to SnippCheck at least annually and there are currently 35 million receipts on the platform. To incentivise consumers to upload receipts, brands need to offer them something in return, which leads me to the next vertical.

Incentivization

This is about rewarding consumers for doing something like making a purchase and uploading the associated receipt.

With Snipprewards, brands can choose to offer consumers something to encourage them to do something else – perhaps buying a specific product, spending above a threshold, and so on. Snipprewards has almost 3000 unique incentives, including financial incentives (e.g. cashback, gift cards, or bitcoin or stock ownership gifts), products (e.g. branded or electronic goods), or experiential awards (e.g. a trip or event tickets). Consumers usually access these awards through a direct brand relationship. For example, through the brand’s app or website, through a link/QR code in-store or on packaging, etc.

Snipp additionally has a unique way to use loyalty points. The module Gambit, acquired in 2022, allows people to bet loyalty points on any sporting event and get cash back or other rewards if they win. From the brand perspective, the extra use case makes their loyalty points more valued by certain consumers. For these consumers, gambling points is an exciting prospect and is a way to get tangible money if lucky. I’ll note that Snipp was able to become qualified as a non-gambling organization since users don’t gamble cash.

The contract for Gambit’s first client Swagbucks was agreed by Gambit’s former owner pre-acquisition. The gross margins were set very low, at around 5%. Gambit has grown well since the launch, generating $6m in the first 9 months of 2022 and $10m in 2023. As a result of the growing revenues and low margins, the gross margins for the entire business were brought far lower than historical averages – they’re at about 30% this year.

However, Gambit now has deals in place with Dave & Buster’s (who have now launched in 48 states) and at least 5 other smaller companies, with a roster of companies still in the pilot stage (including Amex amongst others). The gross margins for these new deals are in the range of 60-70% gross margin. Notably, the big but low-margin contract with Swagbucks has now finished and thus Q1 revenues will likely see a moderate drop in revenues. Fortunately, D&Bs also began their marketing campaign in Q1 so at least some of this drop will be offset by growth with this large client. Though from a lower base, Gambit should continue to grow, and future growth for Q1 and beyond will be at a significantly higher margin than historical margins.

There is currently no other way for users to place bets in sports using loyalty points other than Gambit. They have a first movers’ advantage at least. I believe this to be a difficult market to enter given it is at the intersection of the regulated gambling sector and the niche loyalty program market.

Measurement

Measurement is essentially about finding patterns in the data to understand consumer behaviour better. SnippInsights specifically “[makes] sense of complex consumer behaviours and purchase patterns at a product, brand & category level” (company website). It can produce interactive and dynamic reports centred around enabling better decision marking among marketers.

Amplification

This is about finding customers that fit certain criteria and offering them bespoke deals. For example, if a marketer finds that certain customers love a particular drink with a particular meal, they could find other customers who like that meal but haven’t tried the drink yet and offer it to them. Snipp offers this service through SnippMedia, which is a Payment Media Network (PMN).

While Snipprewards (discussed earlier) already enables SKU-level offers in exchange for receipt validation, SnippMedia differs in two main respects. First, all deals are gathered and accessed through the banking app, rather than directly from the brand (e.g. through the brand's website). This is effectively a form of expanded audience for both Snipp and the brands since many consumers would regularly check a banking app while they may not own or often check a specific brand’s app. Additionally, from the consumer’s perspective, it streamlines finding and utilising deals. Second, Snipp Media is actively working to simplify the process for the consumer by setting up a data feed from banks that would confirm a purchase without the need to scan a receipt.

SnippMedia launched on March 15th this year in partnership with Bank of America. BoA previously partnered with Cardlytics to offer deals for its customers within the BoA app. However, they only offered deals at a retailer level (e.g. for cashback at Walmart’s), rather than deals from brands at an SKU (product or line-item) level (e.g. for cashback when buying Ben & Jerry’s ice cream). Furthermore, Triple by PNC bank will soon also launch, with “a few more” banks also launching this year.

Let’s consider what financial contribution we might expect from Snipp Media in 2025. The launch partner BoA has 47m customers. Tom Burgess, who runs Snipp Media, said on a recent podcast that he expects to have over 120m customers by the end of 2024 purely based on signed contracts. That’s a phenomenal rate of growth, but let’s be conservative and say growth slows massively and Snipp Media only adds 60m customers in 2025. Therefore, the average customer count (roughly the midpoint from the year-start to year-end) for 2024 and 2025 is roughly 60m and 150m respectively.

To make some estimations, let’s ignore any fees Snipp will generate from running the platform (e.g. set-up fees, management fees), and consider a revenue split model based on the deals utilised. I’ll assume only 6m, and 15m million consumers (10% of 60/150m) would consider using their banking app to access deals, a number that feels low to me. I’ll assume each uses one deal a month on average. If Snipp gets $0.10 per deal (a guess at this stage), that’s $0.6m or $1.5m a month for 2024 and 2025. I believe gross margins of 50% would be reasonable. Using these numbers, Snipp Media could easily be generating $7m in revenue in 2024, and $18m in 2025, with $3.5 or $9m gross profit respectively. I do note that pre-launch, we simply don’t know the economics of SnippMedia, and that while I have tried to be conservative, I couldn’t say how close my guesses will be.

Following the launch, this revenue can grow from here in three main ways. First, increase the consumer count that can access the deals by adding banks. Second, increase the number of deals offered, both by adding new brands and showing the brands the value provided by marketing through the platform. The more deals are available, the more frequently deals should be used. Third, educate the consumer, to increase their awareness of these deals and their familiarity with taking advantage of them. This third approach would be the responsibility of the bank and comes down to whether the bank acknowledges the value SnippMedia generates. In summary, the three growth levers are adding banks, adding brands and products, and educating consumers.

As for competition, there are several parties that offer deals based on purchases at a retail level (e.g. cashback for spending $10 at McDonalds). However, Snipp is currently the only platform that provides SKU-level deals. BoA still outsources retail-level deals to Cardlytics (CDLX); as a side note, CDLX is an unprofitable company with a $650m market cap that trades at 2x FWD sales, significantly higher than Snipp. Chase recently launched a similar platform for its customers. However, to date, banks have been unable to offer SKU-level offers because the retailers have no motive to share the required purchase data with the banks. As for competition that would mimic what Snipp does, it is possible, but I believe it’s a difficult market to enter. Snipp has been connecting customers and brands for 10 years and has existing relationships with many Fortune 500 companies. It has the first mover’s advantage. It has a pilot with arguably the biggest bank there is, and that provides a lot of credibility.

Forecasts and valuation

Forecasts

First, let’s discuss revenue growth. Snipp have told the market that they are expecting north of $30m in revenue for FY 2023, putting Q4 at $7.5m or more. From a longer-term perspective, Snipp has an ambitious goal and plan, outlined below.

I note that tripling sales by 2025 is a goal rather than a forecast. That said, how realistic is it? To check this, I’ll outline my assumptions for each of the main units (core, Gambit, SnippMedia, and a potential acquisition) and how they might contribute to revenues moving forward.

· Snipp will generate about $30m in 2023, of which around $20m belongs to the core business. The 3-year CAGR for the core business is 32%, so I’ll just apply that CAGR for 2024 & 2025.

· As for Gambit, we don’t have much of a growth track record. That said, it went from $6m (2022) to $10m (2023). It will dip in Q1 due to the Swagbucks loss, I’d guess by as much as half. How much of this will be offset by D&B in Q1 is unknown, but we should see steady growth for the rest of the year.

· Numbers for Snipp Media discussed in the earlier section.

· Let’s also say Snipp acquires a new business in 2025, which I know they hope to do. I assume this could generate perhaps an additional $5m. Because I don’t know when they’d make the supposed acquisition, I’ll just halve that for 2024.

While tripling revenues by 2025 ($90m) seems plausible but very optimistic to me, I believe a revenue of $72.8m would nonetheless be very notable and impressive level to reach for Snipp. Given the lack of visibility in terms of SnippMedia’s And Gambit’s economics and traction, I prefer to be cautious as I have been in potential revenue growth.

Now let’s explore gross profits. The core business and Gambit will at around 60-70% gross margins, but I’ll take 60%. SnippMedia could be a 50% margin business. I’ve also assumed a mere 30% for the acquired unit since we don’t have more context. Overall, management seems confident in its ability to return to Snipp’s historic gross margin levels, so my estimation of 57% (2024) and 55% (2025) overall gross margins seems reasonable to me.

Next, I calculate operating profit, and convert it into EBITDA. My assumptions are based on the premise of operating cost rising by $2.5m a year, which is above historic annual increases, but lags the revenue growth. Additionally, I expect no reduction in amortization/share payments, so EBITDA should remain at least $1.5m higher than operating profits, though this may even increase. While I feel that at least most of my assumptions have been conservative throughout, I will add an additional layer of safety by reducing EBITDA expectations by a further 40% margin of safety.

Valuation

According to Seeking Alpha, the sector median P/S ratio is 1.25. This strikes me as very low for essentially a tech company with around 50% recurring revenue in the core business, as well as another large portion of repeat business. That said, applying this conservative multiple would give a $59m market cap in 2024, and a $91m market cap in 2025.

Let’s try a valuation using the EV/EBITDA ratio. Snipp has a market cap of around $26m and $5m cash on the balance sheet, so currently has an EV of around $21m. According to SeekingAlpha, the Sector Median EV/EBITDA multiple is currently 9.6 which seems fine. I’ll discount this and use 8x instead, thereby generating the following results.

I feel the EBITDA model would be more appropriate for a profitable company like Snipp. That said, I note that both sets of predictions are in the same ballpark. Given the $25m market cap, you can see that under conservative assumptions, Snipp could well work out to be at least a double based on the 2024 EBITDA, and potential a quadruple based on the 2025 EBITDA.

Balance sheet, cash flow, management and equity

Snipp has a fantastic balance sheet. They have no long-term debt and $5m cash. Last quarter, they were essentially cash flow break even. From this quarter onwards, with a possible exception of Q1 (depending on how much Gambit drops), I believe Snipp will remain cash flow positive. Therefore, I view potential dilution (excluding for accretive acquisitions) as unlikely in the foreseeable future.

One important factor to note is the ownership structure. Snipp has very high insider ownership at around 45%. I really like management having skin in the game, and this one certainly does. 15% is informally owned by friends and family (mentioned in recent one-on-one with management).

One strategic insider is Bally’s, who runs a large gambling operation. They bought around 10% of the company back in 2022 for around $5m. Impressively, they bought those shares at a very nice premium – they paid around $0.20 per share back when the shares were still trading around $0.14 (a 40%+ premium).

That leaves only about 30% of the shares as float. This low amount will certainly increase the volatility of the stock. If price action turns positive, we will likely see it move quickly.

I believe the management team to be outstanding. I’m already far over my preferred word count, so I’ll just point you to their profiles. These people are respected in their fields and could be working in many other prestigious companies.

Risks

Obviously, the biggest risk to the upside is a failure to deliver on aggressive growth goals. However, I find even reducing the growth goals of management as I have above, the upside still looks great. That said, if they fail to keep customers or acquire new ones, even I might be too optimistic, and the upside would be reduced.

Another way the upside could be reduced is if operating leverage is not as powerful as I expect. If operating expenses have to rise faster than I anticipate, less profits will follow.

Unless the outlook for the company changes drastically, I do not foresee cash flow or balance sheet as being a significant risk at this stage.

Changes in privacy regulation would likely affect Snipp. To date, most regulatory changes have been positive for Snipp. For example, the end of cookies only increases the value of generating first-party data. However, it would not be unimaginable for Snipp’s business to be negatively impacted. I do for this reason appreciate that Snipp is diversifying its business modules through various new modules (e.g. Gambit, SnippMedia).

Further risks associated with microcap stocks should be considered. The market value may not reflect the stock's intrinsic value for extended periods. Liquidity will likely remain low until they start generating decent profits.

Author’s Disclosure: I have a beneficial long position in the shares of SPN:CA either through stock ownership, options, or other derivatives. I wrote this post myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. I am not a licensed securities dealer, broker or US investment adviser or investment bank.

Breakout Investors’ Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Breakout Investors as a whole. Breakout Investors is not a licensed securities dealer, broker or US investment adviser or investment bank.

Hi Woody, thanks for the comment. The only COGS they have are campaign infrastructure costs. The other expenses are counted as Opex (if I remember correctly).

Hi Sam, have you seen anything since your article was published that would materially change your investment thesis? I am surprised by how lukewarm the price action reaction to Nov 5 pre-announcement of Q3 results has been. The company inflected well to profitability on EBITDA level, and is now trailing on EV/EBITDA of around 6 when Q3 numbers are annualized (probably not a great idea due to seasonal effects, but it will serve as a crude proxy of where valuation is heading). P/Sales is now 1, which seems quite ridiculous for a company with the roster of clients it has and recurrent streams of income. I am basically just wondering if I am missing something that's brewing under the hood and not immediately visible, or whether market is simply in the pre-discovery slumber yet.