Today we are presenting a guest post from one of our most active members on the Breakout Investors platform, Sam McColgan. Please note that all opinions expressed in this article are Sam’s and may or may not represent the views of our Breakout Investors.

Thesis

It’s been a long time coming, but at last, a tier-1 mobile carrier has launched and seems poised to energetically market Smith Micro’s (SMSI) flagship family-safety platform. Although the opportunity is enormous and seems fast approaching, it seems like the market is only starting to believe it. In this article, I’ll present both cases, so you can come to your own conclusion. However, I believe the risk-reward profile to be extremely favourable. Even modest success should take the stock higher and there is a lot of evidence to suggest that the launch will be very successful.

History and set-up

To really understand the current set-up, it’s important to know the recent history of the company, especially how recent acquisitions have changed SMSI, the competitive landscape and the various dynamics with each of the customers. For those who have followed the name for some time, you may like to skip over the next two sections which will recap the important parts.

Introduction

SMSI develops white-label SaaS solutions and licenses these to mobile carriers who then sell these to their subscribers. It’s a challenging proposition, as carriers are few, slow and unpredictable. However, if successful, once a deal is struck, it’s a win-win scenario. The carrier already has a relationship of trust with its subscribers. If marketed effectively, the product’s subscriber growth can be rapid and very sticky. SMSI and the carrier typically split revenue, so carriers get additional revenue without development costs, and SMSI get a marketing partner and a captive audience.

SMSI currently has three product lines:

SafePath: A family safety app with parental controls and location monitoring. SMSI intend to offer the solution as a platform with different elements including SafePath Family, Home, Drive and IoT. To note, SMSI’s two main customers here have branded the SafePath Family solution as Secure Family for AT&T (T) and FamilyMode for T-Mobile (TMUS). Verizon (VZ) is using a legacy version acquired from Avast referred to as Smart Family.

CommSuite: A modern take on voicemail, enabling users to receive and access their voicemail through text. DISH Network (DISH) is the main customer here.

ViewSpot: Helps carriers customise, design, and manage their in-store screen displays. Additionally, the solution enables carriers to dynamically update price cards in real-time.

Over its lifetime, the stock has done badly, losing much of its value. More interestingly, however, the stock has fluctuated wildly, repeatedly spiking dramatically, and falling again.

SMSI share price chart - max period (Seeking alpha)

SMSI share price chart - 10 year period (Seeking alpha)

SMSI goes in and out of favour with carriers. When in favour, the company’s prospects are bright and the stock soars. When out of favour, the business and stock suffer. In a similar way to commodity investing, to optimise returns, one should invest at the right point of the cycle. In our case, that means to try to invest when SMSI is out of favour, and ideally just before SMSI becomes in favour once again. In this manner, returns can be dramatic. I believe us to be at that precise moment.

Recent events

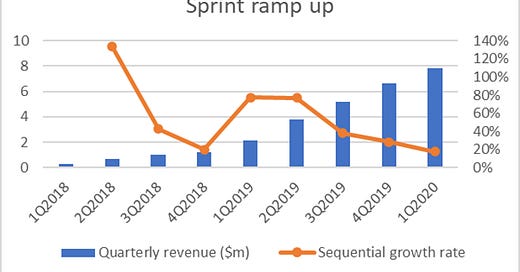

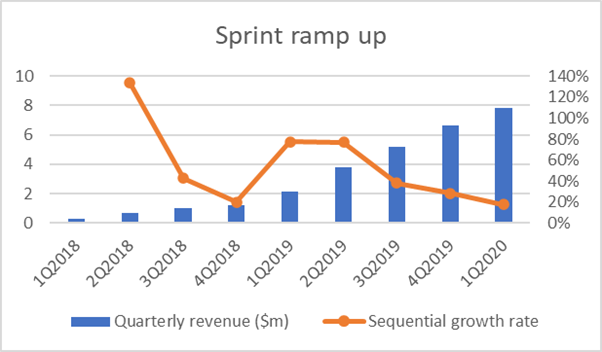

In around October 2017, US carrier Sprint launched ‘Safe & Found’ (a branded version of the SafePath product line) which became a big revenue driver for both companies, especially SMSI. Over the course of around 8 quarters, SMSI’s quarterly revenue from this product alone grew from $300k to a huge $7.85m. As the market began to appreciate and understand the potential here, the stock price went up from under $2 in Feb 2019 to over $6 by August 2019, a rapid triple.

Sprint's deployment of Safe & Found in revenue and growth % (figures from Sprint)

In April 2018, TMUS & Sprint announced their intention to merge. This decision was initially seen with some optimism, as it was hoped T-Mobile might also become an SMSI customer even prior to the merger. However, the merger took a long time to actually occur due to various legal and regulatory challenges. Investors also seemed to increasingly worry that TMUS would discontinue the SMSI deal once merged in favour of its own, or an alternative product. TMUS was also a CommSuite customer (SMSI’s 2nd biggest revenue stream after family safety), and its future was also uncertain.

In February 2020, SMSI bought competitor Circle Labs, which had a family safety product being used by TMUS. SMSI wanted to combine the products to offer a “best-in-breed” solution. Additionally, SMSI believed this put them on both sides of the acquisition, reducing the risk of losing this key customer post-merge.

The TMUS/Sprint merger finally went through in April 2020. The rest of 2020 was a period of integration between the two carriers, as well as an “investment phase” for SMSI. In Nov 2020, SMSI announced the release of SafePath 7.0 (the current iteration), which integrated their own and Circle Lab’s solutions and “includes significant functionality updates such as more robust parental controls, new location and gamification features, and support for children’s wearable devices.” Optimism for a TMUS deal announcement was high. It was around this time that the SMSI stock price began climbing from around 4 to its recent high of 7.5 in February 2021. By the start of 2021, SMSI and TMUS were discussing the launch of the new Family Mode product, expected during the summer of 2021, though they were still working out the contract and details.

With Circle Labs acquired, carriers only had one other ready-to-go option, namely Location Labs, a solution from Avast used by VZ and T. Seeing an opportunity to become the only player in the space, SMSI acquired Avast’s family safety mobile business in April 2021. It was the biggest acquisition to date for the company, costing $66m, for which the company issued a substantial 10M shares, or over a 20% increase to the shares outstanding. In so doing, SMSI acquired VZ and T as customers and seemed to be more likely to win the new TMUS contract. It should be noted, however, that the contract with VZ was not as profitable as others, since Avast had undercut SMSI to win the business. Also, VZ would continue running Avast’s existing app. This meant that SMSI would have to support both, at least initially, which would partially limit synergies.

TMUS’ launch didn’t happen in the summer of 2021. In fact, the contract and launch were repeatedly delayed due to TMUS’ ongoing “reorganization”. Finally, on SMSI’s 3Q2021 conference call, the CEO announced that a deal had been struck with TMUS. Family Mode was expected to launch “as early as 1Q2022”, which it did in March 2022. However, to date, TMUS has not aggressively marketed the product to grow subscribers. Meanwhile, TMUS subscribers were switching networks from Sprint to T-Mobile as part of the ongoing integration. SMSI was thus losing revenue generated by these former Sprint customers who were using SafePath and/or CommSuite. SMSI began depleting their cash and has since accessed capital markets, lifting the share count another 22% since the Avast acquisition. TMUS has more recently been dabbling in some digital marketing, far from the strong launch SMSI was hoping for. They supposedly want to put the Sprint integration fully behind them before getting serious about growing the family safety business.

Unfortunately, things took a turn for the worse with VZ. After the Avast acquisition, SMSI began working together with VZ on a new “more robust” offering, hoped to be released and marketed in 1H2022. On top of new customers, subscribers of the Avast solution were also intended to be transitioned over well before EOY 2022. After some delays, to everyone’s surprise, Verizon terminated the new contract in Feb 2023. Not only would SMSI miss out on the new business, but VZ were developing their own solution, and intended to switch its subscribers away from SMSI’s Avast product to their in-house solution. This meant no new revenue growth, and by the EOY, SMSI will lose a meaningful $4m revenue stream. The fact that SMSI had also done a lot of work leading up to the launch only added to the frustration. The stock understandably nose-dived.

Fortunately for SMSI, T is coming to the rescue. Initially, it was expected that T terminate the Avast contract acquired by SMSI. However, in mid-2021, T came back to the table, apparently interested in the wider platform SMSI offered. The launch was anticipated by EOY 2022, and SMSI began doing preparatory work. The contract was only signed in Jan. 2023, but the migration was pushed back to 2023 due to technical issues at AT&T. Minor delays continued, but AT&T seemed ever closer to launching the product, begin migrating customers over, and marketing. The week before last, T even sent a push notification to many users stating that the product would launch this week. This caused quite the buzz, and the stock price shot up 50% on anticipation. However, the product didn’t launch last week, as the Apple Store approval came later than T expected. The stock has since retracted over 20% likely due to the delay. However, the product received its long awaited update this week, and the stock is quickly climbing back up in response.

Secure Family launch notification (Text message from AT&T)

What success could look like

When asked on the most recent call what to expect from T’s rollout, Bill Smith, CEO, responded:

“I would ask you to maybe look back at how the rollout worked at Sprint. Sprint is half the size or was half the size of what T is to today. It was a remarkable growth activity. We saw a big number of growth quarter-over-quarter. And frankly, that's what I'm looking for here too.”

We’ve been encouraged to compare the current set-up to the Sprint growth story. There are probably several ways to do this. The one I’ve seen a few times is to simply apply the quarterly revenue growth rate from Sprint and apply it directly to T’s numbers. I show this method below. Note, I’m assuming SMSI to finish 3Q with $1.5m revenue from T, and will ramp it up from there.

However, there are a few uncertain factors that complicate this approach. Sprint and T are starting from different baselines. Should you immediately transfer the growth rate, or should you allow Sprint to ‘catch up’ and apply the growth rate once revenues are equal? Also, wouldn’t the growth rate be faster for T, since they have a wider market to address?

Due to various uncertainties, I have applied a different approach. I examine Sprint’s penetration within its own subscriber market, and how this changed quarterly, as this normalises for varying TAMs. I use the absolute growth as a % of market penetration, rather than a regular % growth, as this accounts for differing baselines. This makes logical sense since I do not expect early growth to be a function of the number of existing customers. After all, I believe the new subscribers will be acquired through marketing efforts rather than via network effects (where % growth rates would be more valid). Absolute growth (and not % growth) should correlate with marketing $ spent.

A quick note. In the column ‘Expected penetration growth (smooth)’, I smooth some of the results from the previous column to make the rate of growth less choppy. The overall 8-quarter penetration growth % is the same, and part of the growth is only delayed in two instances. The smooth growth rate is a slightly more conservative estimate.

Above we can see the results. Within 8 quarters of growth, this revenue stream is expected to increase 12-fold. This is obviously substantial for a $100M market cap company. Note that the results show that this method is more conservative than the % growth method.

There are many uncertainties still. T has a different customer demographic and will advertise in different ways to different degrees. It’s hard to know how T’s growth will compare to Sprint’s. Therefore, I present two more scenarios. The conservative case (#2) uses half the expected penetration growth rate, whereas the optimistic case (#3) uses a 50% faster rate. See the results below. There are many more cases, but these should help give you a quick sense. Note that even in the worst-case scenario, they still finish up with $40m annual revenue.

3no. scenarios of expected quarterly revenue growth

How likely is success?

The main reason I hear to suggest the rollout could be slower, and the likely market share smaller, is that there is more competition in the space. This is certainly true. While the carriers have fewer options to choose from, there are many developers going directly to the customer. For a fairly comprehensive list and comparison, see here.

However, there are many reasons to suggest the rollout could be faster, and the possible market size/share larger:

Sprint averaged around 40m retail wireless pre & postpaid subscribers (the TAM) compared to T’s 105m (2.6x larger).

T has almost 5500 retail stores compared to Sprint’s 3800.

T are training staff and paying commission for app sales. Sprint did similarly.

T is contracted to spend a significant $ amount on advertising following the launch.

Recently, child safety has been getting a lot of media and political attention. For example, recently, the US Surgeon General advocating for increased vigilance. Currently, only around half of parents use online family safety tools. If this percentage increases, the addressable market expands. For example, T have 30m family subscription accounts. 15m of these acknowledge the problem and need convincing to switch solutions. Imagine an additional 10% of parents are convinced about the problem and begin looking for a solution. That’s 3m T subscribers who are potential unserved customers. That’s a significant market expansion.

Additional market expansion can come from T utilizing the platform (the reason they came back to SMSI in the first place) and adding products like kids SafePath Drive (driver safety), SafePath Home (extends parental controls to all in-home devices like TV and gaming systems) and SafePath IoT. IoT devices can range from trackers to wearables for kids and the elderly. Last month, AT&T patented a kids watch which may very well be part of the SafePath Secure Family offering by T.

Favourable price point vs. competition. TMUS charges $10/m for FamilyMode, and VZ charges $9.99/m for Smart Family premium. Aura, an alternative DTC provider, charges $37/m. In contrast, AT&T will charge only $7.99/m. and offers a 30-day free trial. This price point is typical for many of the other independent DTC providers, however, these can differ in quality and have no other pre-existing relationship with the customer. Particularly in this inflationary environment, parents will be cost-aware and should be drawn to cheaper alternatives, but want to balance that with quality and convenience.

Valuation

I’ll keep this simple. Q3 revenues, excluding T and the VZ revenues (VZ could drop off after Q4), are likely to be at $5.2m. I’ll use $5m and will assume zero growth in any other part of the business. Adding T’s scenario 1 (from above) means SMSI will generate $27.4m in annual revenue run rate by 3Q2024, and $79m by 3Q2025. OPEX (currently $7.9m) should remain steady, however I’ll add 10% by 2024 and 20% by 2025 for cushion. Using a multiple of 10x, we get a market cap of $377m in two years, compared to under $116m today.

The potential return here is clearly high, especially from a baseline market cap of around $100m. However, the obvious concern above is cash flow until the company becomes sustainably profitable. For more information there, please see the risks section.

Additional upside

In addition to the main thesis on the T launch, there are plenty of reasons for optimism in the other areas of SMSI’s business.

SMSI is expecting to announce additional contracts for the Family Safety business in Europe later this year.

A new Viewspot customer confirmed, likely to be COX (6.5m subs, 130 retail locations).

A new CommSuite customer hinted at – customer unknown, but once we know, you can assume around $0.50 per subscriber annually.

TMUS: Now that the migration is practically complete, we might see TMUS begin to actually market the product. This is even more likely if T’s launch goes well, and TMUS begin to appreciate the value it can generate. This would be extremely bullish.

VZ: If the development of their app goes poorly, which wouldn’t surprise many people, VZ could delay their launch (planned for Q3/4 this year), meaning extending payments to SMSI. In the best case, they could give up and even come back to the negotiation table with SMSI. This would also be extremely bullish.

Risks

Now that the product has officially launched, there are three main risks to the thesis. The first risk is that the T launch doesn’t gain traction. I’ve addressed this in an earlier section already.

The second risk is that T will not energetically market the product. This is unlikely. Significant marketing spending is built into the contract – SMSI have clearly learned their lesson here. Also, I believe many executives at T are not only excited, but they’re feeling very confident as to a successful launch. I won’t directly link their comments out of privacy and respect, but several executives are essentially congratulating each other and SMSI on a job well done, and praising SMSI as “dream partners” on public forums. For the product not to gain traction now would likely be embarrassing for these key individuals. Finally, we can already see that T is marketing the product very well, even before launch. For example, as part of a back-to-school campaign. Below I've posted a few examples of digital advertising, all being run today. The consistency of these ads and more general marketing so far speaks to AT&T being serious about the launch. And downloads have been correspondingly increasing, with the product at all time high rankings for downloads in app stores.

Example 1 of T's digital advertising for Secure Family (Google Ads transparency page)

Example 2 of T's digital advertising for Secure Family (Google Ads transparency page)

Example 3 of T's digital advertising for Secure Family (Google Ads transparency page)

The final concern is the risk of dilution. We can expect positive cash flow in Q3. Thereafter, it’s harder to say. The timing and size of any new business, the timing of VZ revenues drop off, the pace of the AT&T launch, and other factors come into play. The bottom line for me here is – So what? Even if they dilute, the upside is a little reduced. However, at the end of the day, if they can get through 2024, they will start making very healthy profits, and the upside for investors is huge.

Summary

I believe SMSI to be going through a major catalyst, namely the launch and energetic marketing of one of its products by a tier-one carrier. Historically, this catalyst has sent revenues and the stock soaring, and I believe this is very likely to happen again. Risk is present, particularly around cash flow and the need for dilution, particularly if VZ finishes and launches its product on time, and if T’s launch is slower than hoped for. That said, whether or not dilution occurs over the next year, SMSI’s profits are likely to grow rapidly thereafter. I believe the share price growth will lead the company’s profits as investors see T picking up.

Author’s Disclosure: I have a beneficial long position in the shares of SMSI either through stock ownership, options, or other derivatives. I wrote this post myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. I am not a licensed securities dealer, broker or US investment adviser or investment bank.

Breakout Investors’ Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Breakout Investors as a whole. Breakout Investors is not a licensed securities dealer, broker or US investment adviser or investment bank.

Great analysis, thank you. Check the links in the text, they're not working.