Thesis

I rarely find companies with as many growth levers as Nexgel. Their core business is growing in the 80% range, and their various contracts, partnerships, and new developments (many of which will ramp up in 2024/2025) could dwarf the current business. They have a large pipeline of new products, a long growth runway, and a plentiful spare production capacity. They are about to enter new geographies (like Europe). They are enjoying healthily expanding margins and will turn cash flow positive this year. Did I mention they have a monopoly with a moat? My portfolio is already more crowded than I like, but I couldn’t resist making some room for Nexgel.

Introduction

NEXGEL has produced hydrogels for medical device companies for the last two decades. The company chugged along for most of that period with sales around $500k and no sales force or business development staff. Adam Levy was appointed CEO in 2019, a notable turning point for the company. Under his stewardship, the company has expanded the product offering and the client base, and the TTM revenue is up around 570% since 2019.

The company produces solid hydrogels, or patches, which consist of up to 95% water. The gels are medical-grade and biocompatible and can be used in wound care, medical diagnostics, transdermal drug delivery, and cosmetics. Hydrogel patches are better for the skin than regular adhesive patches (e.g., acrylic patches), which can tear away skin cells or otherwise irritate the skin. This is particularly beneficial in medical or cosmetics markets and for patients with sensitive skin.

NXGL’s production process uses an electron beam accelerator (explained below for those interested). Other methods of creating hydrogels, such as chemicals or UV radiation, are unsuitable for medical or cosmetic markets since they are likely to irritate skin.

Production

NXGL operates a 16,500ft2 manufacturing facility in Pennsylvania. The facility has the accreditations you would hope for this kind of product, which are displayed below.

The company has a production capacity of over 1.4bn square inches but is currently only at around 10% capacity, up from around 4% capacity in 2019. The CEO implied that 20-25% capacity would be a notable level. At this point, the factory would be entirely self-sufficient. His goal is to reach 75%+ capacity.

While the factory has ample capacity to expand production, the converting and packing process presented a possible bottleneck for expansion. Given the company had significant customers on the horizon (discussed later), NXGL decided to enter a JV with CG Laboratories, named ‘CG Converting and Packaging, LLC’, down in Texas. They are doubling the footprint of those facilities, with completion works likely finished any day, if not already. I note that the JV is profitable and immediately accretive for NXGL.

Electron Beam Accelerator

This section will get a bit technical and is not essential to the thesis (feel free to skip it). That said, I was curious about how the technology works, and you might be, too.

An electron beam accelerator can improve hydrogel production in the following ways (disclaimer: the following descriptions were generated by AI but tweaked by me).

Crosslinking: Electron beam irradiation can induce crosslinking of polymer chains in hydrogel precursor solutions. This crosslinking helps to solidify the hydrogel structure and improve its mechanical properties. The high-energy electron beam breaks chemical bonds in the polymer chains, allowing them to reform and create a three-dimensional network.

Sterilisation: The high-energy electron beam can also sterilise the hydrogel material, killing microorganisms. Sterility is essential for medical and pharmaceutical applications of hydrogels, which are a key market for NXGL.

Customisability: By controlling the electron beam parameters, such as the beam energy, dose, and dose rate, the degree of crosslinking and the resulting hydrogel properties can be finely tuned. This enables the optimisation of mechanical strength, swelling behaviour, degradation rate, and other characteristics.

Processing efficiency: Electron beam irradiation is a relatively fast and efficient method for crosslinking and sterilising hydrogels, especially compared to other techniques like chemical crosslinking or UV radiation (the most common way hydrogels are manufactured). This can improve the hydrogel manufacturing’s overall speed and cost-effectiveness.

Routes to Market & Use Cases

The company spent its first 15 years providing custom and white-label gels to larger companies (e.g., Bayer and Johnson & Johnson). In the last few years, it embarked on a couple of new routes to market, shown below.

Custom & White Label

NXGL licenses its products to over-the-counter (OTC) brands that go on to market and sell NXGL products. A benefit of this custom, white-label approach is that customers pay a development fee, drastically reducing the financial risk associated with product failure. This business typically signs 2-3 new smaller customers a quarter. NXGL has additionally recently signed highly material deals with AbbVie and STADA that are worth pulling out.

STADA

NXGL partnered with STADA Arzneimittel AG in December 2023. Details regarding the launch can be found here. NXGL will distribute STADA’s products in North America, and STADA will market NXGL’s products in Europe. STADA is especially keen on the Silver Seal product, which I will discuss later. This partnership is impressive given the vast size differential between the two companies. STADA’s first product to be distributed by NXGL will be Histasolv, which nets around $10m in revenue in Europe and is used to treat “histamine food intolerance, which can cause migraines and headaches, gut issues, and skin conditions”.

Sales are expected to begin in Q3. From there, we should see both sides ramp up distribution with more products. I do not know more about the terms of this deal or potential revenue/profit splits. That said, it opens up Europe to NXGL and access to a new product line, so it seems like a big deal.

I will note that NXGL could make a good buy-out target for STADA. I don’t see anything happening imminently on this front, but who knows?

AbbVie

The CEO describes the AbbVie deal as his “largest opportunity.” In mid-2021, AbbVie ($ABBV) acquired Soliton for $550m. Soliton produces the Resonic, an FDA-approved device that treats cellulite in a non-invasive, pain-free manner that lasts over a year. The treatment employs a sonic wave to enter the body at the correct frequency. This treatment requires a high-water-content, biocompatible gel; NXGL is the only suitable product.

Upon landing the contract, NXGL received a $176k deposit in Q1. The launch, initially expected this year, has been pushed back several months and is likely to occur early next year instead.

Let's run through the numbers to get a sense of the scale for this contract. People familiar with AbbVie’s plans think the rollout could be around 900 devices a year, with an upper limit of around 10,000. Each device could perform a couple of procedures a day, six days a week, each requiring two to three large 8x8 pads. We don’t know how quickly the rollout will proceed, so I framed the AbbVie contract contributions below on a milestone basis. Once they hit certain levels of devices installed, these are the ARRs, EBITDAs, and market cap adds I would estimate.

Will the rollout start according to the current timeline? Will they hit 900 a year? How many will they have after, say, three years? There’s plenty of uncertainty. We should continue to watch closely as updates come out.

Medical Devices

Large companies like Avery Dennison, 3M, and Owens & Minor dominate the medical device space. When medical devices interface with the human body (examples below), they can often irritate or damage the skin at the point of contact or entry, especially for people with compromised skin, such as the elderly, diabetics, or people on blood thinners. NXGL plans to license its products to these bigger players for medical procedures. Therefore, it will not need to worry about marketing or competing directly with these giants.

NXGL’s product, NEXDrape, is a patch that can be used during and following surgery. The patch’s efficacy during surgery is on par with current leading products. However, unlike existing products, NEXDrape patches have no adverse effects on the skin upon removal. Three studies have been successfully conducted for this product, showing clear benefits of NEXDrape, and the company intends to file for FDA approval.

NEXDerm has a similar function to NEXDrape but is used for central lines and IVs. The current alternative product is Tegaderm from 3M Healthcare, which is painful to remove post-use and often leaves irritation or damage, symptoms which can lead to infection. Again, the company is filing for FDA approval.

NXGL doesn’t expect to see market traction for these medical device products until 2025. However, if these patches were to become the standard of care in surgeries, central lines, and IVs, the market would be enormous.

Another use case and growth area for NXGL is for eye patches to treat Amblyopia (aka. lazy eye), which affects around 2-3% of children. The advantages of a non-irritant patch are amplified for children who may struggle to ignore irritated skin and risk compliance issues. This product is being launched through ophthalmologist offices and Amazon. Early feedback is good, and management sounded confident in an approaching uptick in demand.

I’ll briefly note that despite these patented products and conducting numerous studies, the associated R&D budget is notably low.

Branded & Consumer Products

During the pandemic's slowdown, NXGL decided to launch a consumer-facing brand on Amazon in Q4 2020. The first product, a Hexagel, was very successful, and the company has continued to expand its B2C offering, now offering 19 products on Amazon. They expect to turn over around $2.5-3m on Amazon alone this year. They have a pipeline of new products and intend to keep expanding the product line.

Additionally, some of the products are now retail-worthy, and NXGL is preparing to launch several products in pharmacies like Walgreens or CVS Health.

The company underwent its final MDR compliance testing inspection in May. The audit is complete, meaning that NXGL can begin to market its products in Europe with the required CE label, including through the STADA partnership. This approval would cover Class I devices, which includes most of their products, including Hexagels and Moist burns pads. However, it excludes Class III devices such as the popular Silver Seal line. There is a possibility that STADA may assist with the application for Class III approval due to the application complexity and the fact that STADA is a large European medical company that has been through the process many times.

Silver Seal

The Silver Seal is NXGL’s hero consumer brand. The product can treat minor- superficial wounds, -lacerations, -abrasions and -first-degree burns. It reduces infections, scarring and pain. Though the brand is relatively new, the underlying product has been used in hospitals effectively without adverse reactions for 15 years. They have also completed a double-blinded study showing its efficacy.

It’s now approved for OTC use and has become their best-selling product on Amazon. The product has great reviews with consumers seeing to appreciate the medical-grade quality. They come in two sizes, and I show them below. Looking at Amazon's numbers, they sell between two and three thousand packs a month at $20. That equates to a minimum of $500k a year, assuming no seasonality or significant fluctuations. NXGL states that it is growing month over month.

Kenkoderm

In Dec 2023, NXGL acquired Kenkoderm. Interestingly, when I asked the CEO what he was most excited about, he said it ought to be AbbVie, but it was this product line. He believed it had huge potential, and the growth was more within his control, not reliant on the timelines of partners.

“The Kenkoderm skincare line was originally developed by a dermatologist to provide alternative treatments for psoriasis that did not use steroids or biologics that often have side effects.”

The acquisition marks a move by NXGL to venture outside of its core technology while keeping the same target customer base. The business was already EBITDA positive and accretive. They paid a reasonable amount for it based on cash flows. It brings some diversification, as well as growth opportunities. For example, the Kenkoderm line is not yet sold in retail and is not approved for Europe, so unlocking these channels or markets should expedite growth. Additionally, the company has a following of 10,000 on Facebook and 35,000 email addresses, so plenty of cross-selling opportunities are shortly to begin.

Competitive Landscape

The company has a monopoly in its niche. There are only two facilities globally that use this technology to create hydrogels, and the other is owned by Medtronic. Medtronic does not compete directly with NXGL. They do not engage in contract manufacturing or consumer brands. In fact, Medtronic is a customer of NXGL, using NXGL’s products for two of their medical devices.

New competition could theoretically enter the market; however, I believe this is highly unlikely. Firstly, setting up a factory and building the machine would likely cost around $10m and take around two and a half years to complete. It would also be challenging to onboard the right technical expertise, as this is a complex manufacturing process. These points make it unattractive for smaller players to enter the space. Secondly, this is not an attractive market to enter. For the big players in the medical device industry, these gels make up a fraction of the entire cost of procedures. It’s pocket change for them at $3-5 a pad, and the margins aren’t exceptional, so the incentive isn’t there for them to enter the market.

While the electronic beam manufacturing process is unpatentable, NXGL has individual product patents.

Financials, Forecasts and Valuation

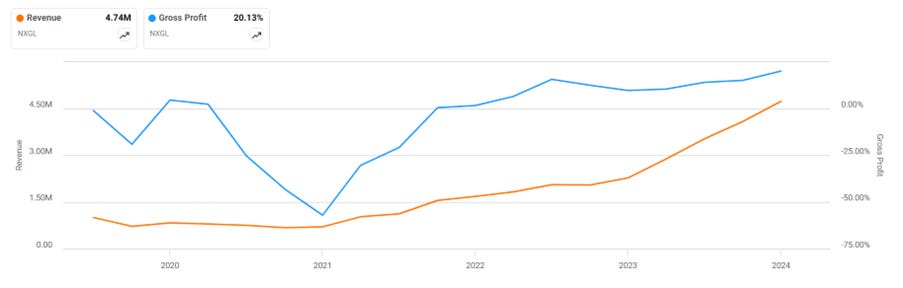

Revenues are growing quickly, hitting $4.1m in 2023 and $1.3m in Q1 this year. Management recently released preliminary results of $1.4m for Q2 this year and guided for a step-up to $2.2m and $2.6m in Q3 and Q4, respectively. This would put revenues at $7.5m for 2024, an astounding 83% growth rate in 2024. Speaking with the CEO, he seems to be the type who issues guidance cautiously and doesn’t want to miss it. I expect Q3 and Q4 to be marginally above the guidance, if not higher.

Substantial fixed costs are associated with running a factory. As production scales, margins dramatically improve. You can see that gross margins only flipped positive in late 2021. Gross margins averaged 15% in 2023 and hit 22% in Q1. Management states that margins will continue to improve, given the high fixed costs. I will note that margins fluctuate considerably from quarter to quarter, so it is better to make comparisons on an annual or semi-annual basis.

The challenge with modelling this company is that margins for different parts of the business react to growth differently. For example, when serving B2B customers, gross margins will improve as production increases, while operating expenses will grow far slower. In comparison, for B2C, a more significant portion of the expenses would go towards sales & marketing, which would have to ramp up more in step with sales. For this reason, though I expect to see a steady increase in gross margins as production continues to increase, I will not break down my gross margin estimates.

Instead, management thinks about margins by excluding the fixed costs associated with running the plant; these are baked into the current financials. Then, all additional revenue will come with its own “contribution margin”. This contribution margin accounts for additional COGS (e.g. labour and materials but excluding the fixed costs) and additional OPEX (e.g. S&M). Therefore, knowing the contribution margins is effectively an approximate method of estimating how much EBITDA we could expect for each type of revenue. Margins for contract manufacturing should be around 50%; Amazon sales should be between 20 and 25%; the packaging JV should be between 35 and 45%. Without knowing the growth rates for each segment, I would propose the broad average gross margin contribution to be around 35%. Therefore, as the business scales, the EBITDA margins should slowly approach this 35%.

2025 forecast

I will now explore what 2025 financials could look like:

Existing business: $7.5m+ revenue in 2024, representing 80% growth; we had $1.3m in Q1 and $1.4m in Q2 and expect at least $2.2m in Q3 and $2.6m in Q4. If we simply add $200k a quarter from there, which strikes me as conservative, we reach $12.4m in revenue for 2025, which is $4.9m additional revenue. It translates to 65% growth YoY. Assuming the business is EBITDA neutral at the start of the year, we can just add the contribution profit. If the contribution margin is around 35%, that’s around $1.7m EBITDA.

AbbVie: Let’s assume delays or a slower rollout than expected; say they will only install 450 devices next year. The year’s average device install base is half of that (devices towards the end of the year won’t contribute much). Therefore, we could expect around $1.3m in revenue added, with around $650k EBITDA.

STADA: This one is very hard to account for. I don’t know how quickly they will roll out products, how quickly they will find traction, or what the revenue split will be. I would guess this could add at least $1m in revenue next year, but I will exclude it from my valuation because of the uncertainty.

Medical devices: This segment includes NEXDrape and NEXDerm. Both should launch in 2025, but I don’t know how quickly they’ll find traction. I’d hope for at least a $500k contribution, but I will exclude these products for now.

Overall: Considering the conservative numbers for the existing business and AbbVie sales, we could see $13.7m+ in sales next year. That could equate to around $2.35m EBITDA.

Valuation: With an EV of $18.7m, we’re trading at around 8x next year’s EBITDA. This sounds reasonable until you consider how conservative my EBITDA is, and the company's growth profile. We didn’t assume big growth in the legacy business. We assumed the AbbVie rollout would be 50% slower than expected. We ignored potential contributions from the STADA contract and the upcoming medical device products. I would not be surprised to see 2025’s EBITDA over 50% higher than my estimate or more, in which case the business is starting to look very cheap indeed. If the business grew again by 80% in 2026, I could imagine an EBITDA of well over $6m.

Balance Sheet and Cash Flows

NXGL’s balance sheet should be considered as a risk factor. They have $2.4m in cash and $2.4m in working capital. They lost $1m in operating activities in Q1. This should improve slightly in Q2 and substantially in Q3. They expect to be at break-even cash flow in Q4. Assuming this is the case, let’s say they use up $900k in Q2 and $300k in Q3. That would suggest a drop in working capital by around $1.2m before breaking even, roughly halving their working capital.

This aligns with comments from management. Adam, the CEO, has stated for some time that they would not need to raise cash before turning cash flow positive. While they did raise $1m in cash in Q1, this was essentially to fund the Kenkoderm acquisition. The CEO continues to state that they will not need cash to break even. Assuming they hit their guidance, this appears achievable. However, if they take longer to break even than expected, they may have to raise capital via debt or equity. Additionally, they might raise again if they see another attractive and accretive acquisition target.

Capital structure

The debt/equity ratio is close to one. The company does not issue preferred stock.

A part of the capital structure to note is a high outstanding warrant count. The company has 6.23 million shares outstanding, with additional shares that could be issued shown below.

The largest element of these is the warrants. I should note that the stock is around 50% of the current average exercise price of the outstanding warrants. The share price will likely take some time to push past the warrants. However, there is plenty of upside before that point. Additionally, the management team would appreciate the extra cash to drive growth.

Management

I was very impressed with Adam, the CEO. I’ve seen him present and spoke with him on a separate occasion. He seems highly competent in numerous areas, including finance, operations and marketing. I like that he has investment banking experience and should know how to structure good deals for shareholders. It’s worth checking out his bio.

I will note that the CEO is hoping to onboard a COO. This will free him up for the activity he believes he is best at – closing deals.

The table below shows high insider ownership (~25%) within NXGL. Five of six board members (including the CEO and the CFO) own shares, with ownership ranging from $250k to $1.7m worth.

Many of these shares were bought with their own cash. You rarely see recent insider trading charts look this bullish. Drapczuk, CFO, recently bought an impressive $100k shares on a salary of $208k.

Technical analysis

Immediately following the IPO in December 2021, priced at $5.50 a share, the stock fell substantially. It has traded in the $1.20 to $3 range. I see a sideways wedge pattern forming. It has recently spiked, likely due to the impressive guidance and being picked up by various communities. I believe that once the share price breaks the resistance of $3, it will have a nice run-up. The stock may have temporary difficulty breaking through the warrant’s strike price, but that’s still a double away.

Summary

Nexgel appears to be firing on all cylinders and then some. It is growing at 80% and will break even this year. It’s expanding margins and is punching way above its weight, signing deals with industry behemoths. Given how many different growth avenues they have, I’d say it’s likely that they will sustain this level of growth for at least another year or two before slowing down. Companies of this calibre should be priced at a premium. Instead, NXGL is priced at less than 8x a very conservative forward EBITDA. I would be surprised if the company does not double its market cap in short order, triggered by a jump in revenues, turning profitable, and having more clarity on some of the bigger partnerships, like AbbVie and STADA.

Terrific work Sam, there is a lot to like with the stock

wow...