Setting the Scene

Mohnish Pabrai, who happens to be my favourite investor, has a favourite investment he loves to talk about. This investment frames my latest investment so well that I thought it worthwhile to share the story in his own words.

IPSCO was a company trading at about $42 odd dollars a share. It had no debt, about $14 in cash per share on its balance sheet, and had publicly stated that the next two years of earnings would be $14 each.

So, I thought, “Okay, they are sure of the future earnings because they have contracts locked in. Taking the current cash plus the next two years' cash inflow equals the stock price. They've also got all this plant and equipment, inventory, brand and everything else. All those extra things are available for nothing.

Markets don't like uncertainty. After the two years, there was absolutely no visibility on what earnings would be. They could go to one dollar; they might even go negative. We have no idea. Because of that uncertainty, the markets were unwilling to give this a ten-times multiple. They felt this was peak earnings.

My take was, why don't I just buy the stock and watch this movie play out for two years? Get some popcorn, turn on a big-screen TV, watch the movie and see how it unfolds. So, I did that. I put about 10% of the fund’s assets into IPSCO around 2004.

About six or seven months later, they announced they had one more year of earnings visibility and would again make another $14. I just said, "Hallelujah, God loves me."

So, the stock is now at $60 and change because, you know, markets can now see that $42 is too low… [some time passes and] then markets got a little bit more bullish about them, and the stock was trading at about $85 or $90 a share. They had not made any more announcements. We just had the sixty dollars guaranteed. I was thinking about whether I should take my chips off the table. I didn't know what would happen after year three, just like anyone else.

While I was running through all these kinds of mind games in my head, I woke up one morning and saw IPSCO at $148. It was just a straight line up. I said, “Whoa, what's going on?”. It turned out that a Swedish company offered to buy them for about $155. So, I said, “God truly loves me”. After all, I was happy to take my chips off the table at $90 and move on. I did not wait for that deal to close. I didn't even wait for IPSCO to respond to that offer. I just immediately placed sell orders. We were done with IPSCO.

I think, eventually, that deal closed for $160 or $165 or something. It became a private company under that Swedish company. I think the thing is that sometimes Wall Street gets confused between risk and uncertainty. This is an example of that. IPSCO was a business with very high uncertainty but very low risk. When you combine high uncertainty and low risk, the result is usually going to be very high returns; that's a good formula to keep in mind.

I’ve heard this story several times, and it always strikes me. Since then, I’ve been on the lookout for these types of investments, and I finally found one.

Introduction

HeartCore is a tale of two business units. They have a fast-growing, sticky enterprise software business with a strong foothold in Japan. Additionally, they offer a consultancy that assists Japanese companies to list on the NASDAQ in exchange for fees covering expenses and 1-4% of the company in warrants, which they sell soon after the IPO. These two very different businesses should be understood separately and as part of a whole. They have also recently acquired an IT consultancy in the US, which may act as a platform for further international expansion.

Thesis

HeartCore is a high-uncertainty, low-risk investment. It carries many of the trademarks of the IPSCO investment.

As of Q2, HeartCore is currently trading at $0.80 and has around $0.79 per share of assets (all assets excluding intangibles and goodwill) and $0.97 of liabilities. That’s $0.18 per share of net debt.

Management has guided towards $0.34 in earnings in Q3. They have additionally said publicly they expect a similar number for Q4. Adding $0.68 of earnings to $0.18 of net debt gives you a net asset of $0.50. The current share price is $0.80. Thus, investors get almost two-thirds of the investment in assets. I admit, that’s not quite the 100% that Mohnish got to, but it’s not far off.

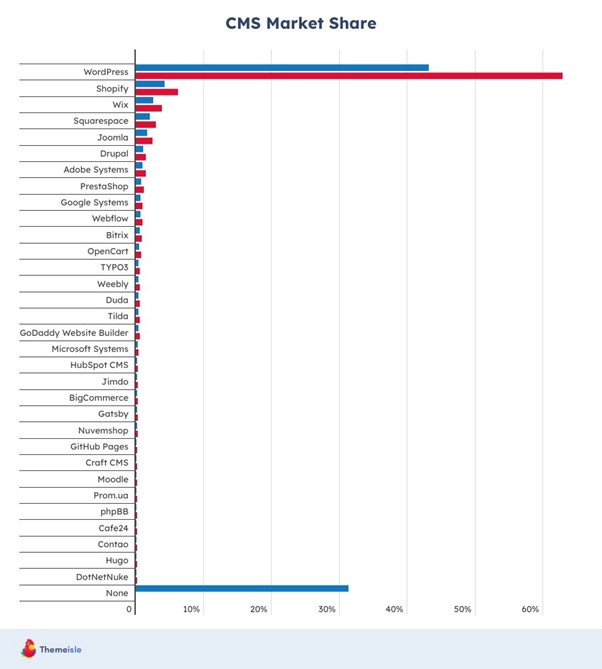

HeartCore’s core business (enterprise software and consulting) is not yet profitable, but management claims it could be profitable at the flick of the switch if it stopped investing in growth. They are investing in a CMS platform better suited to the international market and expect to launch it in the US next fall. To give a sense of the scale of the opportunity, Squarespace has a 3% market share and generates around $1.2bn in revenue at around 25% EBITDA margin. While there are positive indications (discussed later) that HeartCore could find traction in the US, I’m not counting on this. It could flop; it could be a home run.

The software business provides additional upside but isn’t required for the investment to work out. The IPO business alone is a sufficient cash cow to protect investors from the downside and hopefully provide a nice upside. HeartCore has eight clients on the path to IPO, which should all be completed within the next 18 months. Let’s assume one doesn’t make it; at $4.25m an IPO (conservative), that’s a potential earnings bucket of $30m (compared to a market cap of $17m).

HeartCore aims to IPO five to ten companies annually. Let’s say they only achieve two a year. That would put the annual earnings at $0.40 a share (concentrated in one or two lumpy quarters), provided the software business grows or cuts expenses enough to operate at breakeven. In this scenario, HTCR is trading at 2x earnings even though it will have two-thirds of its market cap in cash by the end of the year. If they have five companies a year (their lower estimate), the P/E would be 0.8x.

A lot would have to go wrong for this investment not to work out. First, the software and consulting business would have to remain unprofitable indefinitely. We’d have to assume that it would not be able to grow and that management would be crazy enough to continue to pour money into the growth without seeing any results. We’d have to assume that management was either lying about the ability to cut expenses or was unwilling to do so. The second thing that would have to go wrong is that the IPO business utterly falls apart. They’d not only have to stop landing new clients, but most of the clients they already have in place would have to give up on the process. I believe the chances of both happening simultaneously to be less than 5%.

If they can meet their IPO goals, or their product lands in the US, it’s easy to imagine scenarios in which this is a 10-bagger.

The Core Business

Software

HeartCore offers four different categories of enterprise software:

HeartCore CMS – A content management system (centralised management of digital assets) and a customer experience management (CXM) software (front end of CMS)

HeartCore Robo – A robotic automation process (automating repetitive digital tasks)

myInvenio – A process mining (process mapping) software

Controlio – A task mining software (monitoring the computer activity of employees)

Digital Transformation

The latter three solutions above fall under the ‘Digital Transformation’ revenue stream; they are currently insignificant and shrinking in size. That said, management does believe they have the potential to play a more significant role in revenues. I am skeptical until I see results.

Content Management System

Investors should focus predominantly on the CMS and CXM software, which comprise over 80% of SaaS sales.

HeartCore CMS Functionality

HeartCore CMS is a ‘headless CMS’. Headless CMS systems are content management platforms that separate the backend content repository from the frontend presentation layer. This decoupled architecture allows content to be created, stored, and managed independently of how it's displayed, enabling greater flexibility in content delivery across multiple channels and devices.

There is a significant trend towards adopting headless CMS solutions, driven by the need for omnichannel content delivery, improved performance, and greater developer flexibility. According to recent research, 73% of surveyed businesses use headless architecture. The trend is expected to continue, with 98% of those not currently using headless planning to evaluate such solutions over the next 12 months. This shift towards headless CMS reflects the growing demand for more agile, scalable, and future-proof content management solutions in an increasingly digital-first business environment.

I’ll discuss key points around the HeartCore CMS below, including its relative strengths:

All-in-One Package: HeartCore CMS offers a comprehensive solution beyond simple website distribution and information dissemination. It provides a unified platform for managing various digital assets and content types.

Personalization: Unlike many traditional CMS platforms, HeartCore enables content distribution tailored to customer demographics. This personalisation feature allows for more targeted and effective communication with audiences.

Multi-Channel Distribution: HeartCore supports content distribution across various channels, including websites, apps, digital signage, social media, and IoT devices. This versatility suits companies looking to maintain a consistent brand presence across multiple platforms. Apparently, it was the first CMS to integrate and analyse various data from the web, chat, social media, and in-store purchase data to achieve journey orchestration (source).

Digital Asset Management (DAM): The CMS includes robust DAM functionality, allowing centralised management of diverse digital assets such as photos, videos, illustrations, CAD files, and more. This feature streamlines content management and ensures consistency across all marketing materials.

Workflow Management: HeartCore offers sophisticated workflow capabilities, including content creation, modification, approval, and publication processes. This ensures efficient content management within organisations.

Integration Capabilities: The CMS can integrate with various systems, including mission-critical systems, LDAP/OpenID authentication, e-commerce platforms, accounting systems, and CRM tools. This makes it suitable for complex site builds like intranets or e-commerce platforms.

Multilingual Support: HeartCore includes high-performance automatic translation functions, simplifying the management of multilingual sites.

Accessibility Features: The CMS provides built-in accessibility check functions (compliant with standards like JIS X 8341-3 and WCAG), supporting inclusive information dissemination.

Customisable Interface: HeartCore offers a familiar editing interface with Word and Excel-like controls and options for screen customisation to suit different user preferences.

Flexible Deployment: Users can choose between on-premises deployment or cloud-based solutions, including a SaaS offering on AWS with managed services.

Robust Security: HeartCore emphasises security, making it a popular choice in industries with high-security requirements, such as the financial sector.

Efficient Content Migration: The CMS offers a streamlined content migration process, allowing large amounts of content to be transferred quickly using zip files.

The company expects to release version twelve of the CMS solution in 2025. This is considered a significant upgrade that incorporates several more AI features. Management believes this product will attract many customers. It is intended to be a critical step towards the international expansion discussed below.

Market Position

Customers seem to like the solution. HeartCore CMS is the most used CMS in Japan, with just shy of one thousand customers and about 25% of the market. The company aims to increase this market share to 40%. Their client list is full of impressive Japanese companies (Note: check page 3 of the latest investor deck for the list of clients.) HeartCore CMS competes domestically (in Japan) against household names such as Adobe and Sitecore.

HeartCore has a small foothold overseas, with 25 customers internationally. International revenue is currently small but could dwarf the Japanese business if expansion goes well. I spoke with management about the expansion into the US, which is expected to officially kick off during fall 2025. I also noticed that the investor presentation mentioned India. Both the US and India are enormous markets.

The CEO Kanno has mentioned that he aims to achieve a 10% market share in the US. This is, in all probability, way too ambitious. Still, I’m okay with Kanno dreaming big, and I hope he surprises me. For context, Squarespace has a 3% market share and generates around $1.2bn in revenue at around 25% EBITDA margin. HeartCore currently has $12m in revenues for its CMS. Achieving a 10% market share would be incredibly difficult. The bottom line is that it’s hard to say how well this product will land in these new geographies. A 1% market share would be a home run for investors.

Sigmaways (Consulting)

Sigmaways is an IT services consultancy founded in 2006, based in Fremont, California. It provides product engineering, digital transformation, and staffing solutions to various industries. The company specialises in helping businesses leverage technology for strategic advantage, offering services from digital product creation to IT consulting. Sigmaways focuses on delivering agile, tailored solutions to help clients navigate the complexities of digital transformation and stay competitive in their respective markets.

The company is well respected and has an impressive list of clients, many of which are Fortune 500 (Note: the list of clients is on page 10 of the latest investor deck).

HeartCore acquired a 51% majority stake in Sigmaways in February 2023. This acquisition makes sense. It established a footprint in the US and globally and should lead to cross-sell and upsell opportunities. I believe this process has not yet started significantly, as HeartCore intends to launch version 12 before marketing strongly in the US. It remains to be seen how effective this cross-selling is.

Current Economics of the Core Business

The revenue split between the software (Japan) and consulting (US) is around 50/50. Sales have not increased in H1 compared to H2 last year. I find this odd, especially since the company still stated in its most recent presentation that it expects 30% organic growth for 2024. I do not believe they will hit this goal, though I hope sales pick up in the latter half of the year. Sigmaways’ CEO attributed the lack of growth to the restrictive rate environment, leading to a reluctance from companies to invest in IT improvements. He feels confident that 2025 will see a resumption of prior growth trends. A good reason for optimism overall is that by 2Q2024, the pipeline had increased by 130% YoY.

Gross margins are currently in the 20% range, surprisingly low for SaaS. However, it’s worth noting that this includes maintenance, support, and the consulting part of the business. Gross margins are far higher in the industry, in the 60% region. Management believes this could sit considerably higher in a couple of years, perhaps around 40%. I think it will depend primarily on the growth of the CMS.

To play out a potential scenario, let’s say HeartCore grows its core business by 10% this year and another 20% next year; they’ll hit $17.5m this year and $21m in 2025. If gross margins improve to 27%, the core business could make $5.75m in gross profit in 2025. Operating expenses are heading downward, currently at $10m a year. If they stay at this level, the SaaS business will make a $4.25m operational loss next year. That loss would essentially balance out with one IPO.

There’s a lot to like about the software business. The product is well received in Japan, with impressive capabilities and happy clients. However, it is currently unsustainable. I’m curious to see how it plays out moving forward. The IPO business can cover the loss for now, but I’d like management to improve the core business's economics within two years. A successful launch in the US would undoubtedly help in this regard. Otherwise, I would encourage management to cut expenses or sell the business.

Go IPO Consulting

The Go IPO business is really what makes this business investable for me in the near term. I believe it is a cash cow business that the market is discounting beyond reason.

Kanno (CEO) owned the second Japanese company to ever uplist in the US. He became expert enough to write a book on the subject and begin offering consulting services to other Japanese companies which hope to uplist in the US, too.

The services offered include translating financial statements into US GAAP, translating other vital documents into English, organising the required team (including underwriters, auditors, and lawyers), assisting with the audit, preparing the S1 filing, and general hand-holding.

HeartCore has strict criteria for the companies it takes as clients, such as:

Dominant market position

More than $750,000 net income for two consecutive years

Ability to pay $2M in IPO costs

Other competitors have entered the space since HeartCore launched. HeartCore competes on quality rather than cost. They have completed every uplisting process contracted for, except for a fraction of companies which changed their minds about IPOing in the States.

HeartCore describes current market conditions in NASDAQ as very difficult. One would assume that these conditions would improve sooner or later.

Economics

Here’s the business model. HeartCore charges a fee that covers its associated costs, typically between $380k and 900k at near-zero margins. Once it IPOs, HeartCore takes 1-4% of the company in warrants, which it sells soon after.

IPOs are wildly different in size, so I’m not expecting a consistent amount per IPO. That said, it would be helpful to estimate the average value of each IPO to HeartCore for forecasting. I’ll use two methods to estimate the value:

Four companies have completed the IPO. While the range has been large, the average revenue per IPO is $5.9m.

HeartCore are now only engaging with companies with over $50 million in revenue. Typical ratios for software companies with around $50m revenue are around 3x to 5x sales, implying that HeartCore aims for IPO sizes of at least $150 to $250m. Warrants for smaller companies tend to be 3% or more. Using these figures would mean at least $4.5m in revenue for HeartCore. Remember that this is a minimum; the average would presumably exceed $4.5m.

Combining the two estimates, I’ll assume a conservative $5m revenue. This often falls straight to the bottom line with no expenses. However, as we saw with the SBC medical IPO, several companies may have a referral fee of around 30% of the total warrants. Assuming half of the companies might have this referral fee (so far, only one of four had one) implies that profit per IPO on aggregate would be reduced by around 15%. This means for $5m worth of warrants, earnings would be $4.25m. This translates to $0.20 per share as my conservative earnings estimate per IPO.

Pipeline

To date, HeartCore has signed fourteen clients. Four have completed the IPO, and two have reversed their decision to proceed. That means there are eight companies in the process of completing an IPO. Assuming around seven of these make it in due course seems reasonable, implying an earnings pipeline of around $30m (market cap $17m).

They expect to sign another four customers within 4Q2024. This feels very ambitious, and I’m curious how many of these come through. If they only sign two contracts this quarter, I’d be thrilled.

They had only one successful Go IPO Listing in 2024. This is the SBC medical group IPO, for which they were awarded 2.7% warrants, representing $17m. The revenue for the IPO will be recognised during the quarter in which the IPO occurs, so in this case, in Q3. HeartCore has already sold $9m of those warrants before the IPO to ease cash flows. We can expect the remainder of the cash to show up this quarter.

Accounting note for those interested: As for the revenue amount to be recognised, I gather that the auditor did not mark the unsold warrants at market value; instead, they discounted the unsold portion of the warrants. Some of the revenue will appear as a marginal gain instead of revenue, although the earnings will be unaffected.

Three more IPOs are in the final stages of an official IPO, with the company targeting completion in the next couple of months. Achieving this would lead to a tremendous year, though it wouldn't matter too much if a couple spilled out into early next year.

HeartCore is keen to move up the food chain regarding IPO sizes. For example, I will briefly note that HeartCore has finalised an engagement letter for a company with $2b in revenue. It’s not a landed deal – but it shows the kind of clients they are looking for. If they were to acquire a company at this scale, what’s the upside? Let’s assume 3x sales; the IPO would be $6b. 2% warrants translate to earnings of $120m. I’m not counting on this, but as long as they keep getting a couple of small IPOs each year, investing in HTCR feels like playing the lottery for free (with better odds).

Management

HeartCore boasts very high insider ownership. The CEO, Kanno, is a true owner-operator, owning just over 50% of the shares. Total insider holdings represent a prodigious 75% of the total shares.

Kanno is a quirky character, and I mean that in the best way. He thinks and operates differently. He started his career as a pilot in the Air Force because he loved the movie Top Gun. He went on to create a snowboarding company, which was at the forefront of the snowboarding boom in Japan for a time. He learned his lessons, later founding and selling other companies. After a stint at a US IT firm, he went on to found HeartCore.

Kanno recognises the value of customer loyalty; the central mission of his company is to make customers happy. He’s fully invested in what he does, and he loves what he’s doing. I believe him to be an honest guy with high integrity. It’s worth reading interviews (such as this one) or watching interviews (like this one) where they spend a lot of time discussing his leadership style, background and philosophy.

I’ve also met with other key leaders in the organisation. They share an excitement about where the business is heading. Everyone seems to be gearing up for big things in 2025. I also consistently get the impression that this is a good team that means what it says. It remains to be seen how overly optimistic they are, but I do not believe they are being disingenuous.

Technical analysis

The weekly chart above shows that the stock has followed a clear downward channel since it started trading in early 2022. Finally, it broke out of that channel in the last three weeks.

At the end of 2023, we observe a triple bottom (though the first bottom goes notably lower than the other two). The stock doubled within weeks but has since continued in a steady downward channel; the top of the new channel was in line with the longer-term trend, but the channel was far narrower.

In late September, as the stock was beginning to tip-toe over the top of the channel, the company released impressive guidance for Q3; and the stock spiked an additional 20% in short order on good volume (after already being 36% up off the lows). The stock then retreated, giving up all the post-guidance gains. However, it held onto the pre-guidance gains. Thus, it retraced 50% of the run and began shooting up again like a textbook chart. This is an attractive chart, and I feel confident in the momentum.

Summary

Investing in HeartCore feels like playing poker with free table stakes. By the end of the year, the company should have two-thirds of its market cap in cash. It will be trading at around 2x PE. It currently has a backlog of around $30m in earnings (compared with a market cap of $17m). Additionally, it has the most popular CMS platform in Japan, and it’s beginning to expand into new markets. The IPO business is difficult to emulate as it relies heavily on reputation, which takes time to build. A passionate owner-operator runs the business. The stock is breaking out of a long-term downtrend. While there are risks, they’d all need to go wrong at once for this investment not to work out. If either the IPOs or the software business does better than the worst-case scenario, it’s easy to imagine how this stock multi-bags.

wow

What's your thoughts on this company now? The scenario and run at the end of 2024 had this looking great, but ever since the calendar turned 2025... it's been terrible. It's hard to get a lot of information and other people's opinion on this very small cap stock. Thanks in advance.