Data I/O introduction

Data I/O DAIO 0.00%↑ is a company that has been on my radar for years during which the stock has mostly trended down. I think we are about to witness a turnaround though. For example, they just announced their largest ever adapter order, which is a leading indicator for future performance and we had some insider buying, including from the CEO, that the company also highlighted in a press release. Maybe most importantly though, this is happening with the backdrop of a management change late last year.

Management change

The CEO of Data I/O is William "Bill" Wentworth. He officially assumed the role on October 1, 2024, after serving as a board member since May 2023. With over 35 years of industry experience, Bill brings a wealth of expertise in programming technologies, mergers and acquisitions, and strategic management. His major accomplishments include his tenure as CEO of Source Electronics—a global leader in programming and test services—where he was instrumental in executing high-profile transactions. Notably, he led the sale of a controlling interest in Source Electronics to HIG Capital in 2001 and later orchestrated its sale to Avnet in 2008, transactions that produced significant returns for investors. His leadership at Source Electronics also saw the development of innovative programming solutions for the automotive and consumer industries, establishing a clear focus and reducing customer concentration.

In addition to his track record of transformative leadership and deal-making, Bill Wentworth has also leveraged his expertise as a consultant through his role at Wentworth Advisors, focusing on programming, IT, and private equity markets.

We had the opportunity to speak with Bill (more on that at the end of this article) but one thing is clear: He’s the man. His expertise and understanding of the industry is outstanding. The changes he has initiated are already impacting the numbers in form of revenue growth and cost reduction. His early changes center on strategic growth via new revenue channels, a revamped go-to-market model, enhanced operational efficiency, and a renewed focus on leveraging the company’s core technological strengths. These steps are all aimed at driving a turnaround and preparing Data I/O for future success in a rapidly evolving, security-focused marketplace.

Since taking over as CEO in October 2024, Bill Wentworth has initiated a series of strategic and operational changes designed to reposition Data I/O for long‐term growth and market leadership. Here are some key initiatives and changes he’s implemented so far:

Strategic Reassessment and Growth Focus: From the outset, Bill has placed a strong emphasis on generating growth by unlocking new revenue streams. He’s been evaluating both organic opportunities—such as maximizing the use of the company’s state-of-the-art programming and secure provisioning systems—and inorganic avenues via potential acquisitions or partnerships. His plan is to leverage Data I/O’s robust balance sheet and impressive global customer base as a foundation to expand market reach in high-growth sectors like automotive electronics and IoT.

Refining the Go-to-Market Strategy: Bill’s transition plan includes a reevaluation of the current go-to-market models. By shifting from a transactional sales approach to a more consultative, customer-centric strategy, he aims to build deeper, long-term relationships with key clients. This customer-first approach is expected to help the company better align its product offerings with evolving market demands, ensuring that Data I/O’s programming solutions remain both competitive and innovative.

Operational and Product Enhancements: Recognizing the importance of efficiency in a competitive operating environment, Wentworth is focused on streamlining operations. This means increasing system utilization and optimizing internal processes to drive higher margin contributions—particularly through the expansion of high-margin consumable adapter sales. Additionally, as someone who has been a long-term user of the company’s technology, his hands-on insight is fueling initiatives to modernize and secure the programming systems that are critical to the automotive and electronics manufacturing sectors.

Leveraging Industry Experience and Customer Insight: With an extensive background that includes leading a key competitor and orchestrating major M&A transactions, Bill is bringing a fresh perspective to Data I/O. His prior experience as a customer gives him a unique vantage point to pinpoint areas of improvement in product development and market strategy. Essentially, he is merging deep industry know-how with a proactive approach to make Data I/O more agile, resilient, and better positioned to capture emerging market opportunities.

Based on the most recent quarterly results and management commentary, Data I/O is showing encouraging signs of progress in its recovery. In the first quarter of 2025, the company reported a 19% revenue increase to approximately $6.2 million and improved operational metrics such as higher EBITDA and a better cash balance compared to previous quarters. Although Q1 still ended with a modest net loss (around $382,000), this result marked a significant improvement over past performance—indicating that the turnaround initiatives are beginning to bear fruit.

Management is actively executing several strategies to drive this recovery, including increased system utilization, streamlined operations leading to a lower cost basis, and an enhanced focus on high-margin consumable adapter sales. These measures are poised to help reverse the trend, but the full-year profitability for 2025 remains subject to several uncertainties. Global economic headwinds, continued tariff and trade tensions, and cautious customer capital spending can all influence the pace at which these improvements translate into sustained profitability.

Overview

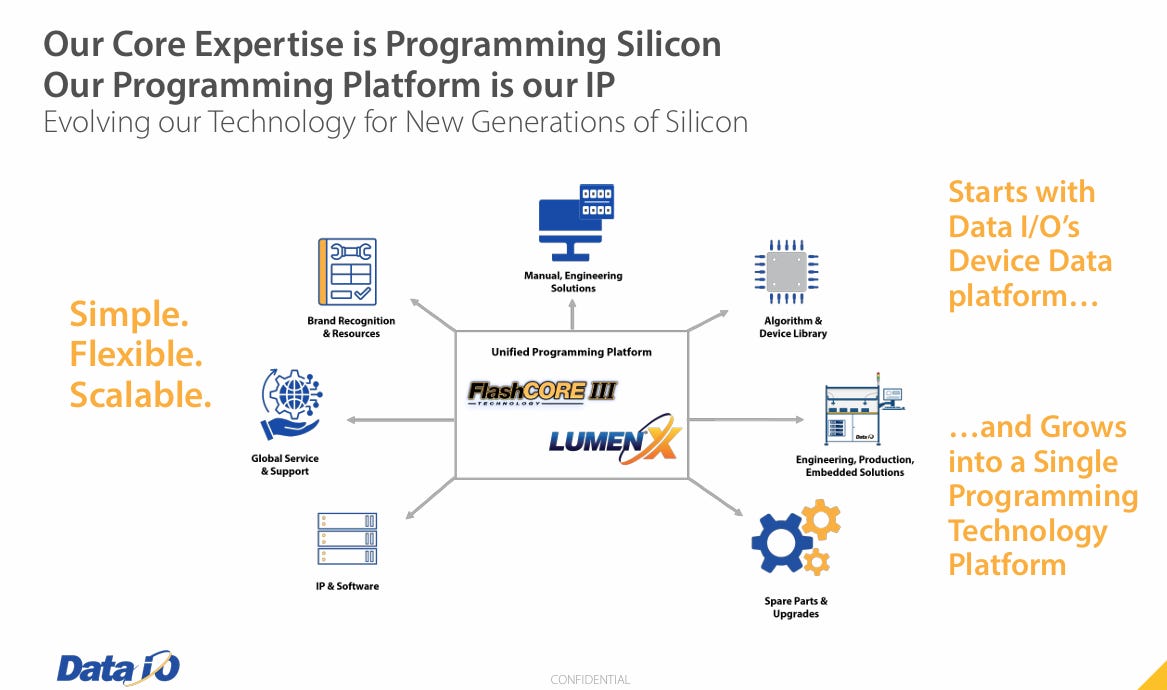

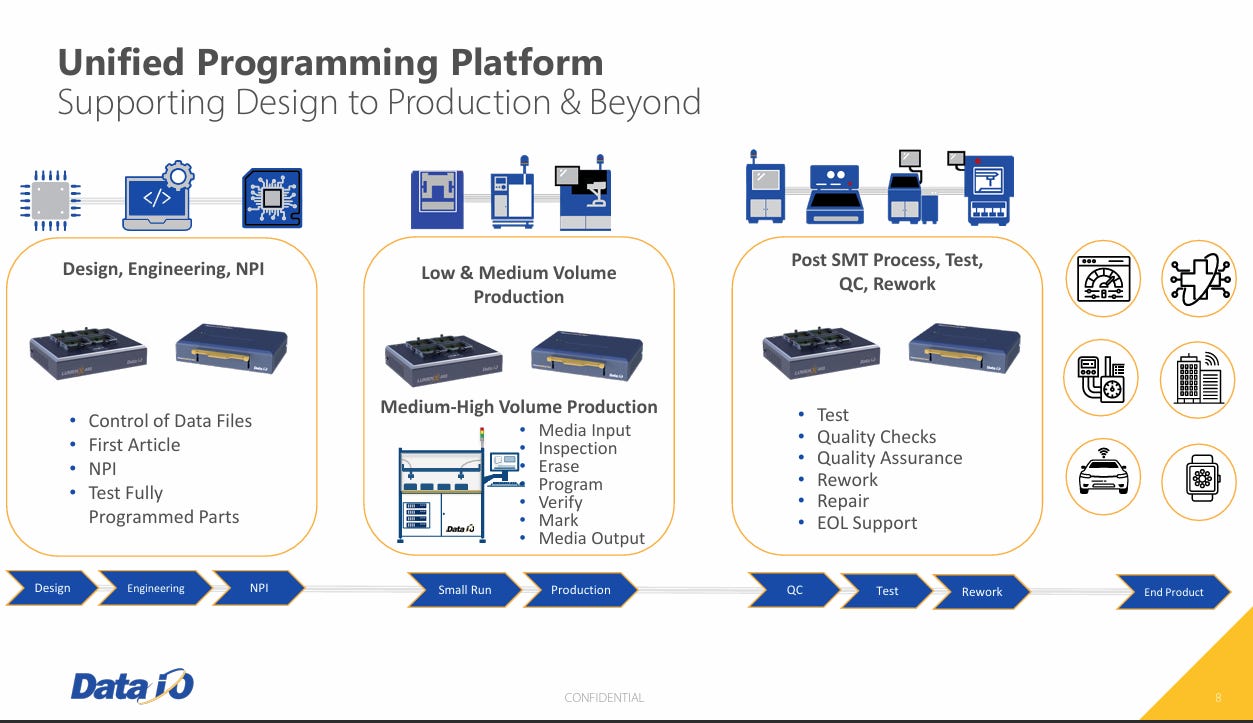

The company designs, manufactures, and markets specialized equipment for programming semiconductor devices. In essence, they build both manual and automated systems that write data—such as firmware or configuration information—into flash memory, microcontrollers, logic devices, and other non-volatile chips. These systems are crucial for ensuring that electronic devices, ranging from consumer electronics to industrial and automotive components, perform the functions intended by their designers.

In addition to basic programming, Data I/O has evolved its technology to incorporate security provisioning. This means their systems not only load data into a device but also securely provision cryptographic keys and authentication credentials. Their solutions are integrated with high-security modules (for example, FIPS 140-2 Level 3 compliant hardware security modules) to safeguard against counterfeiting and unauthorized access. As a result, the company’s technologies are particularly valued in sectors where security is paramount—such as automotive electronics and the Internet of Things (IoT)

Beyond these core offerings, Data I/O's innovations support efficient manufacturing processes in both high-volume and smaller-scale operations, contributing to the reliable production of secure and feature-rich electronic devices. This commitment to quality and innovation has cemented their reputation as a trusted partner in various high-growth markets such as automotive, medical, industrial controls, and IoT.

Data I/O is capitalizing on several converging trends in secure programming and smart manufacturing:

Enhanced Performance and Throughput: Data I/O’s innovations, such as the VerifyBoost feature for its LumenX programming systems, are driving significant performance gains—reportedly a 64% increase in programming throughput in some applications. This improvement not only lets manufacturers leverage existing production capacity more effectively but also reduces the overall cost of programming devices. In an industry moving toward higher-speed production and tighter efficiency margins, such performance enhancements directly address market demands for rapid, cost-effective manufacturing processes.

Integration with Smart Manufacturing and Industry 4.0: The rise of Industry 4.0 has brought about a paradigm where manufacturing ecosystems demand real-time data exchange, full traceability, and seamless integration between production equipment and enterprise-level systems such as Manufacturing Execution Systems (MES). Data I/O’s ConneX Service is a perfect example—it enables two-way integration between device programming systems and external applications. This connectivity not only improves process analysis and factory throughput but also enhances quality control and traceability, aligning with the ongoing trend of connected and automated smart factories.

Robust Security Provisioning: With the increasing proliferation of IoT devices and connected automotive systems, security has become an intrinsic design requirement rather than an add-on. Data I/O's platforms—especially its SentriX security provisioning solutions—are designed to embed hardware-rooted security into devices during manufacturing. By integrating cryptographic keys and security credentials during programming, Data I/O helps manufacturers establish a solid supply chain-of-trust and safeguard against tampering or counterfeiting. This proactive approach mirrors the broader industry trend of incorporating security early in the design and production phases to mitigate emerging cyber risks .

In essence, Data I/O is strategically positioned at the intersection of these trends. They are not only enhancing the speed and efficiency of device programming but also embedding robust security measures and integrating seamlessly with modern, connected manufacturing infrastructures. This multifaceted approach enables them to meet the evolving needs of sectors such as automotive, IoT, industrial control, and medical applications.

Financial performance

Data I/O’s financial performance over the past few years has been mixed, reflecting both challenging market conditions and strategic adjustments by management. For example, while the company managed to generate revenues in the range of approximately US $20–30 million per year over recent fiscal periods, its net income has featured notable volatility. In fiscal 2023, Data I/O posted a modest positive net income in one quarter but then slipped back into losses in other periods. Analysts have noted that in 2024 the company faced a challenging year—reporting a full‐year revenue decline of about 22% down to roughly US $21.8 million, and a net loss of around US $3.1 million. These results illustrate how external headwinds such as global trade tensions, shifts in capital equipment spending, and broader economic uncertainties have had an impact on its financial performance.

Despite these challenges, recent quarterly updates have shown signs of improvement. For instance, the Q1 2025 results reflected sequential growth across key metrics such as revenue, operating income, EBITDA, and cash balance—even as the company navigates ongoing tariff and trade uncertainties. Management has emphasized that increased utilization rates of existing systems and the growth of higher-margin consumable adapter sales are beginning to drive a positive shift. This indicates that the company’s investments in operational efficiency and a more consultative sales approach may help stabilize and even improve financial results in the near term .

Looking ahead, Data I/O is positioning itself for a turnaround. Their forward-looking strategies include leveraging dual manufacturing sites (in the US and China) to mitigate supply chain risks and adapting to evolving customer needs in secure programming and IoT. Although the outlook remains cautiously optimistic—given potential headwinds from global economic conditions and ongoing shifts in customer capital expenditure—the company’s focus on innovation and its internally driven cost efficiencies could lead to top-line growth and a rebound in profitability over the coming years. Meanwhile, insider confidence, as evidenced by recent open-market purchases by senior management, underscores a belief that the current share price does not fully reflect the company’s intrinsic value or future growth potential .

Financial trends in the semiconductor and secure programming markets, which continue to emphasize security provision and operational efficiency, are likely to play a significant role in Data I/O's recovery.